Question: Problem 4-33 (LO. 1, 3) Ann and Bob form Robin Corporation. Ann transfers property worth $420,000 (basis of $150,000) for 70 shares in Robin Corporation.

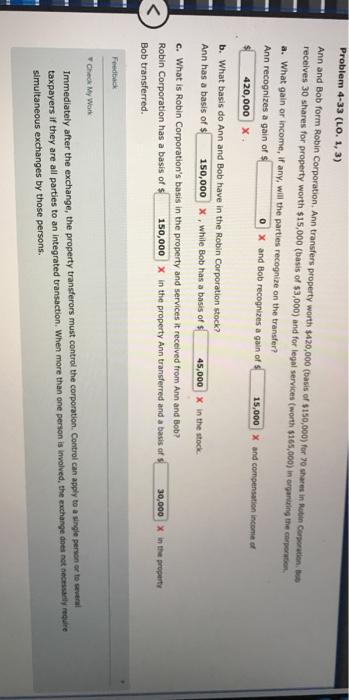

Problem 4-33 (LO. 1, 3) Ann and Bob form Robin Corporation. Ann transfers property worth $420,000 (basis of $150,000) for 70 shares in Robin Corporation. Bio receives 30 shares for property worth $15,000 (basis of $3,000) and for legal services (worth $165,000) in organizing the corporation a. What gain or income, if any, will the parties recognize on the transfer? Ann recognizes a gain of $ O X and Bob recognizes a gain of $ $ 420,000 X 15,000 X and compensation income of b. What basis do Ann and Bob have in the Robin Corporation stock? Ann has a basis of $ 150,000 X, while Bob has a basis of $ 45,000 X in the stock. c. What is Robin Corporation's basis in the property and services it received from Ann and Bob? Robin Corporation has a basis of $ 150,000 X in the property Ann transferred and a basis of Bob transferred. 30,000 X in the property Feedback Check My Work Immediately after the exchange, the property transferors must control the corporation. Control can apply to a single person or to several taxpayers if they are all parties to an integrated transaction. When more than one person is involved, the exchange does not necessarily require simultaneous exchanges by those persons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts