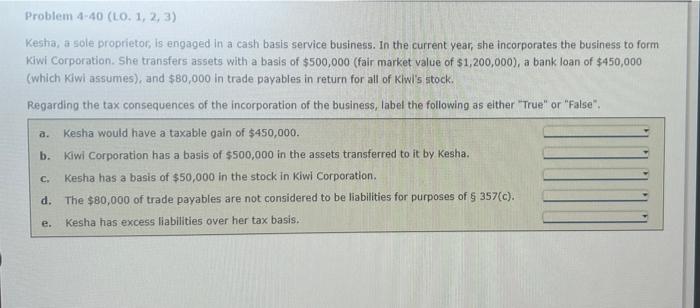

Question: Problem 4:40 (LO. 1, 2, 3) Kestra, a sole proprietor, is engaged in a cash basis service business. In the current year, she incorporates the

Problem 4:40 (LO. 1, 2, 3) Kestra, a sole proprietor, is engaged in a cash basis service business. In the current year, she incorporates the business to form Kiwi Corporation. She transfers assets with a basis of $500,000 (fair market value of $1,200,000), a bank loan of $450,000 (which Kiwi assumes), and $80,000 in trade payables in return for all of Kiwl's stock. Regarding the tax consequences of the incorporation of the business, label the following as either "True" or "False". Kesha would have a taxable gain of $450,000. b. Kiwi Corporation has a basis of $500,000 in the assets transferred to it by Kesha. Kesha has a basis of $50,000 in the stock in Kiwi Corporation. d. The $80,000 of trade payables are not considered to be liabilities for purposes of g 357(c). Kesha has excess liabilities over her tax basis. a. C e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts