Question: Problem 45 44. Cor 35, are Tufis do n information, compute their tax owed or refund due for 2018. child eax credit (Ch. 9). From

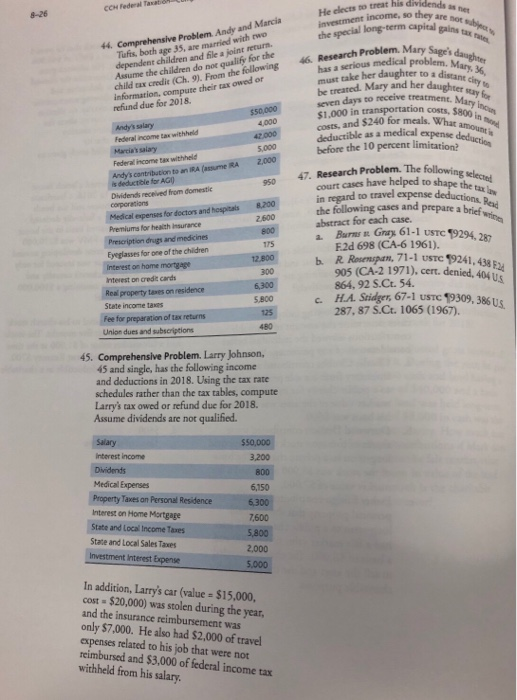

44. Cor 35, are Tufis do n information, compute their tax owed or refund due for 2018. child eax credit (Ch. 9). From the costs, and $240 for meals. What amou before the 10 percent limitation The following selected 47. Researh have helped to shape the ta la Andy's contribution to an IRA (assume RA a alw a Burns Gray 61-1 USTC 19294 b and prepare a brief wi Premiums for health Insurance F2d 698 (CA-6 1961). R Rompa, 71-1 USTC 9241.434 905 (CA-2 1971). cert. dlenied,404 U4 864, 92 S.Ct. 54 H.A. Stidger, 67-1 uSTC 19309, 38 ts 287, 87 S.Ct. 1065 (1967). 1200, Interest on home mortgage Interest on credit cards Real property taxes on residence State income taxes Union dues and subscriptions 45. Comprehensive Problem. Larry Johnson, 45 and single, has the following income and deductions in 2018. Using the tax rate schedules rather than the tax tables, compute Larrys cax owed or refund due for 2018. Assume dividends are nor qualified. interest income 3,200 Medical Expenses Property Taxes on Personal Residence 6300 Interest on Home Mortgage State and Local Income Taxes State and Local Sales Taxes Investment Interest Expense 6,150 In addition, Larry's car (value $15,000, cost $20,000) was stolen during the year, and the insurance reimbursement was only $7,000. He also had $2,000 of travel expenses related to his job that were not reimbursed and $3,000 of federal income tax withheld from his salary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts