Question: Problem 5 (15 Marks) Anakin Inc. is analyzing the possible acquisition of Luke Ltd. Both firms have no debt. Anakin currently has 1 million

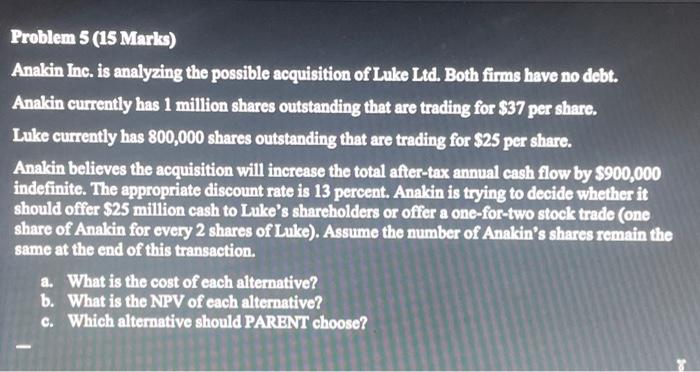

Problem 5 (15 Marks) Anakin Inc. is analyzing the possible acquisition of Luke Ltd. Both firms have no debt. Anakin currently has 1 million shares outstanding that are trading for $37 per share. Luke currently has 800,000 shares outstanding that are trading for $25 per share. Anakin believes the acquisition will increase the total after-tax annual cash flow by $900,000 indefinite. The appropriate discount rate is 13 percent. Anakin is trying to decide whether it should offer $25 million cash to Luke's shareholders or offer a one-for-two stock trade (one share of Anakin for every 2 shares of Luke). Assume the number of Anakin's shares remain the same at the end of this transaction. a. What is the cost of each alternative? b. What is the NPV of each alternative? c. Which alternative should PARENT choose?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts