Question: Problem 5 - 4 ( Algo ) Investment analysis; uneven cash flows [ LO 5 - 3 , 5 - 8 ] Helga is considering

Problem Algo Investment analysis; uneven cash flows LO

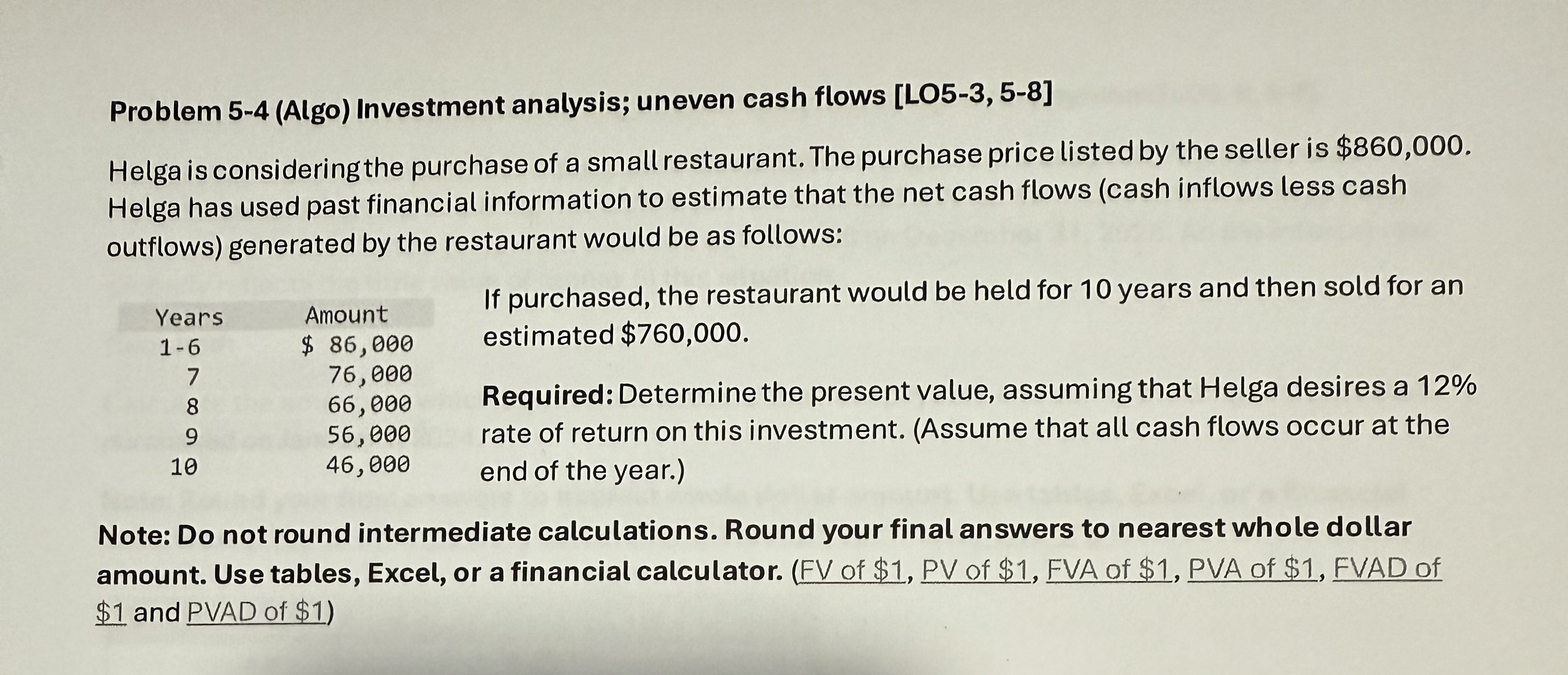

Helga is considering the purchase of a small restaurant. The purchase price listed by the seller is $ Helga has used past financial information to estimate that the net cash flows cash inflows less cash outflows generated by the restaurant would be as follows:

tableIf purchased, the restaurant would be held for years and then sold for anYearsAmount,estimated $$Required: Determine the present value, assuming that Helga desires a rate of return on this investment. Assume that all cash flows occur at theend of the year.

Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock