Question: Problem 5 - 5 0 ( LO 5 - 2 ) ( Algo ) [ The following information applies to the questions displayed below. ]

Problem LO Algo

The following information applies to the questions displayed below.

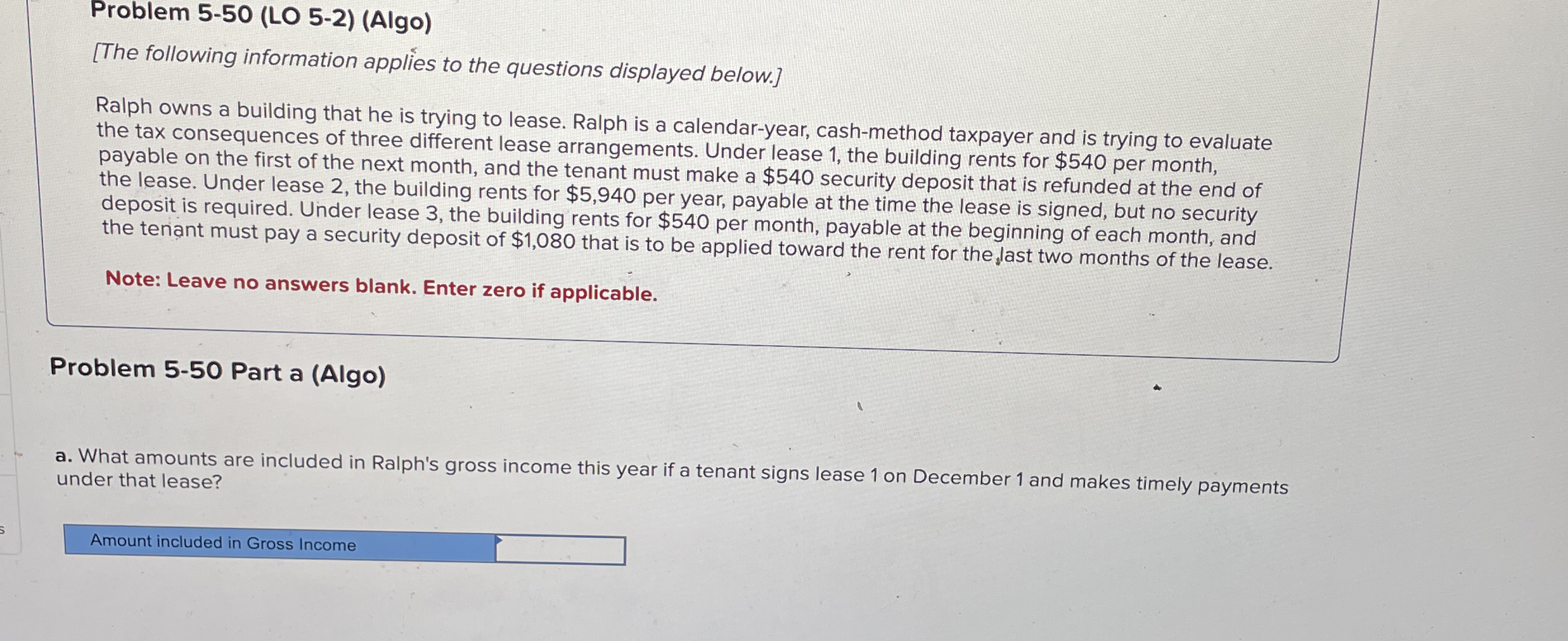

Ralph owns a building that he is trying to lease. Ralph is a calendaryear, cashmethod taxpayer and is trying to evaluate the tax consequences of three different lease arrangements. Under lease the building rents for $ per month, payable on the first of the next month, and the tenant must make a $ security deposit that is refunded at the end of the lease. Under lease the building rents for $ per year, payable at the time the lease is signed, but no security deposit is required. Under lease the building rents for $ per month, payable at the beginning of each month, and the tenant must pay a security deposit of $ that is to be applied toward the rent for the last two months of the lease.

Note: Leave no answers blank. Enter zero if applicable.

Problem Part a Algo

a What amounts are included in Ralph's gross income this year if a tenant signs lease on December and makes timely payments under that lease?

Amount included in Gross Income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock