Question: Problem 5) Bob and Joe decided to liquidate their jointly owned corporation, Pennsylvania Corporation. After liquidating its remaining inventory and paying off its remaining liabilities,

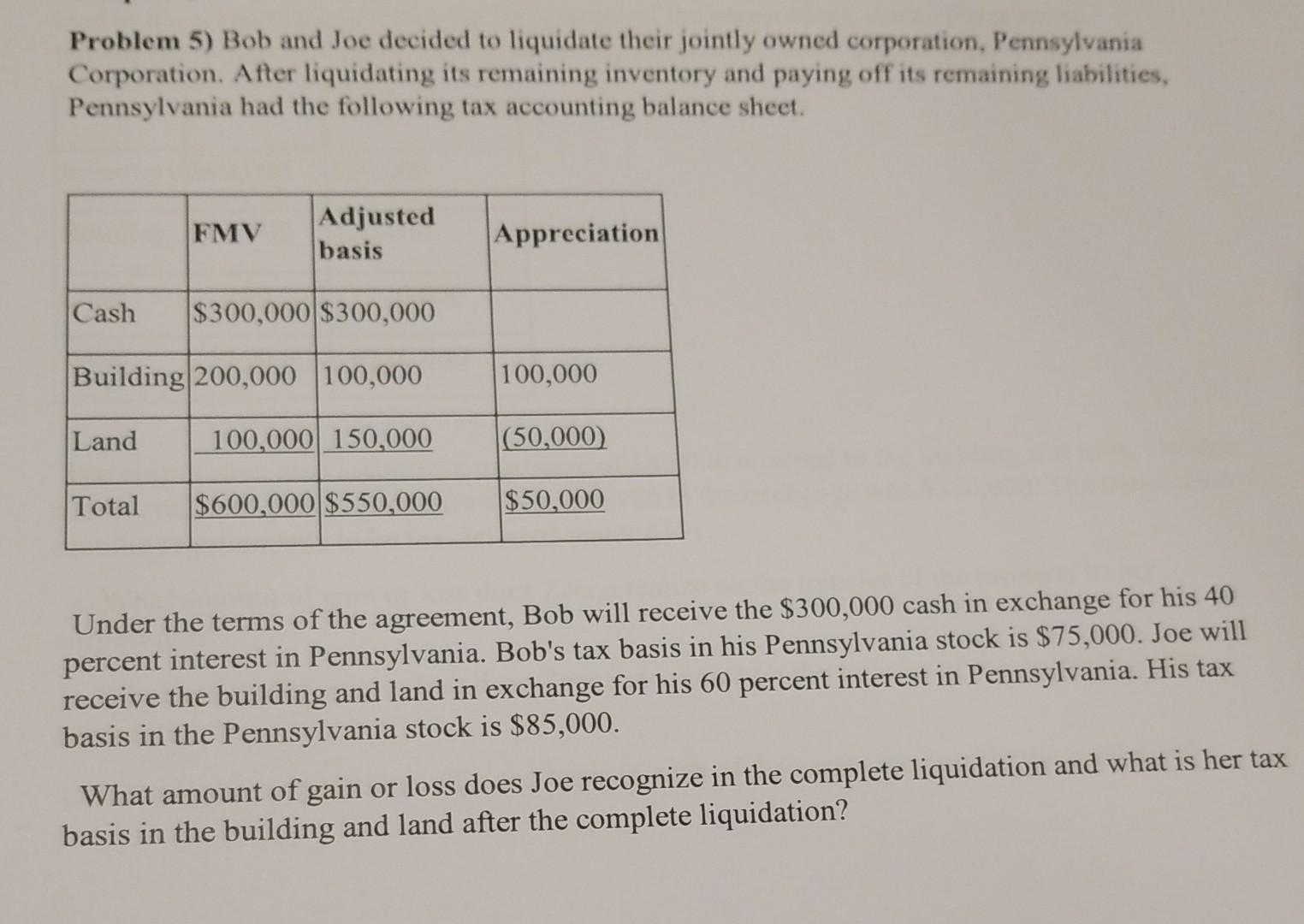

Problem 5) Bob and Joe decided to liquidate their jointly owned corporation, Pennsylvania Corporation. After liquidating its remaining inventory and paying off its remaining liabilities, Pennsylvania had the following tax accounting balance sheet.

Under the terms of the agreement, Bob will receive the $300,000 cash in exchange for his 40 percent interest in Pennsylvania. Bob's tax basis in his Pennsylvania stock is $75,000. Joe will receive the building and land in exchange for his 60 percent interest in Pennsylvania. His tax basis in the Pennsylvania stock is $85,000.

What amount of gain or loss does Joe recognize in the complete liquidation and what is her tax

basis in the building and land after the complete liquidation?

Problem 5) Bob and Joe decided to liquidate their jointly owned corporation, Pennsylvania Corporation. After liquidating its remaining inventory and paying off its remaining liabilities, Pennsylvania had the following tax accounting balance sheet. Under the terms of the agreement, Bob will receive the $300,000 cash in exchange for his 40 percent interest in Pennsylvania. Bob's tax basis in his Pennsylvania stock is $75,000. Joe will receive the building and land in exchange for his 60 percent interest in Pennsylvania. His tax basis in the Pennsylvania stock is $85,000. What amount of gain or loss does Joe recognize in the complete liquidation and what is her tax basis in the building and land after the complete liquidation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts