Question: Problem 5. Consider three stocks X, Y, Z in a world where stock returns depend only on two types of systematic risk, Inflation risk and

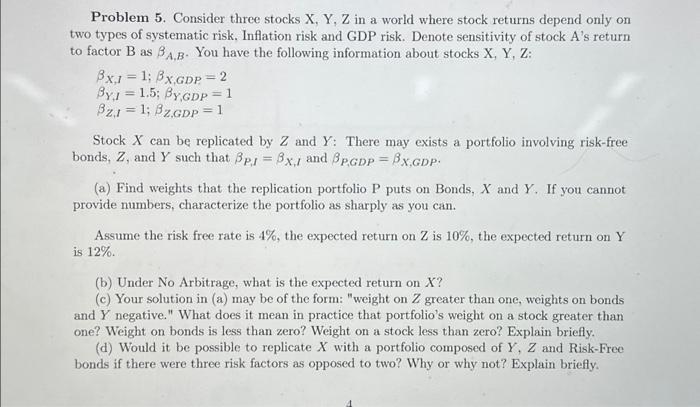

Problem 5. Consider three stocks X, Y, Z in a world where stock returns depend only on two types of systematic risk, Inflation risk and GDP risk. Denote sensitivity of stock A's return to factor B as A,B. You have the following information about stocks X,Y,Z : X,I=1;X,GDP=2Y,I=1.5;Y,GDP=1Z,I=1;Z,GDP=1 Stock X can be replicated by Z and Y : There may exists a portfolio involving risk-free bonds, Z, and Y such that P,I=X,I and P,GDP=X,GDP. (a) Find weights that the replication portfolio P puts on Bonds, X and Y. If you cannot provide numbers, characterize the portfolio as sharply as you can. Assume the risk free rate is 4%, the expected return on Z is 10%, the expected return on Y is 12%. (b) Under No Arbitrage, what is the expected return on X ? (c) Your solution in (a) may be of the form: "weight on Z greater than one, weights on bonds and Y negative." What does it mean in practice that portfolio's weight on a stock greater than one? Weight on bonds is less than zero? Weight on a stock less than zero? Explain briefly. (d) Would it be possible to replicate X with a portfolio composed of Y,Z and Risk-Free bonds if there were three risk factors as opposed to two? Why or why not? Explain briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts