Question: Problem 5: Hedge Funds (4 points) (a) Which would you prefer as an investor (circle one)? Why? i An investment with a 20% return half

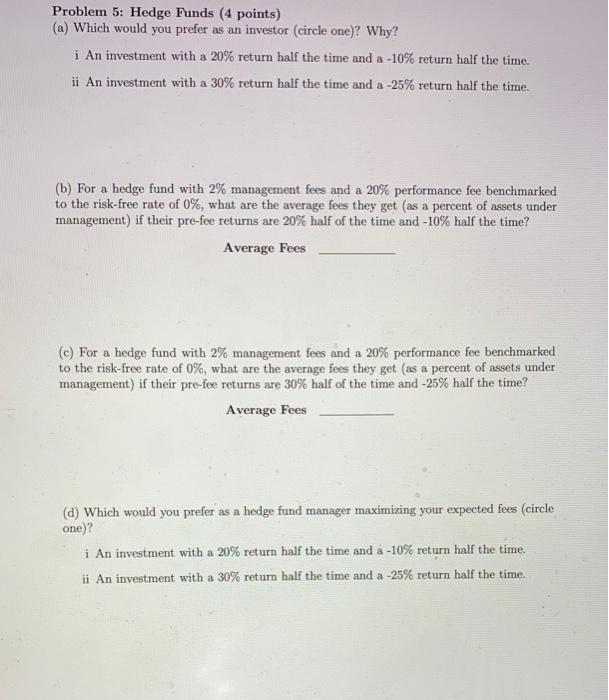

Problem 5: Hedge Funds (4 points) (a) Which would you prefer as an investor (circle one)? Why? i An investment with a 20% return half the time and a -10% return half the time. ii An investment with a 30% return half the time and a -25% return half the time. a (b) For a hedge fund with 2% management fees and a 20% performance fee benchmarked to the risk-free rate of 0%, what are the average fees they get (as a percent of assets under management) if their pre-fee returns are 20% half of the time and -10% half the time? Average Fees (c) For a hedge fund with 2% management fees and a 20% performance fee benchmarked to the risk-free rate of 0%, what are the average fees they get (as a percent of assets under management) if their pre-fee returns are 30% half of the time and -25% half the time? Average Fees (a) Which would you prefer as a hedge fund manager maximizing your expected fees (circle one)? i An investment with a 20% return half the time and a -10% return half the time. ii An investment with a 30% return half the time and a -25% return half the time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts