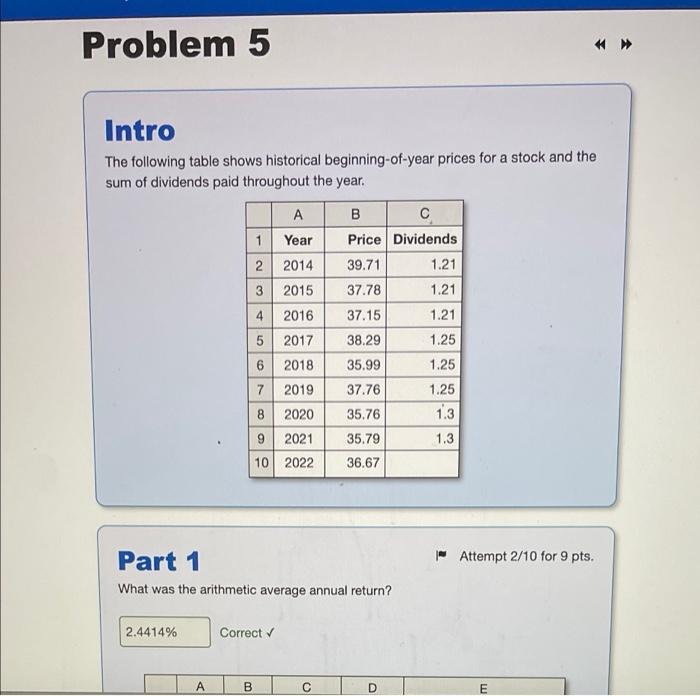

Question: problem 5 : need part 2 please answer both right for an upvote problem 13 need part 1 Problem 5 Intro The following table shows

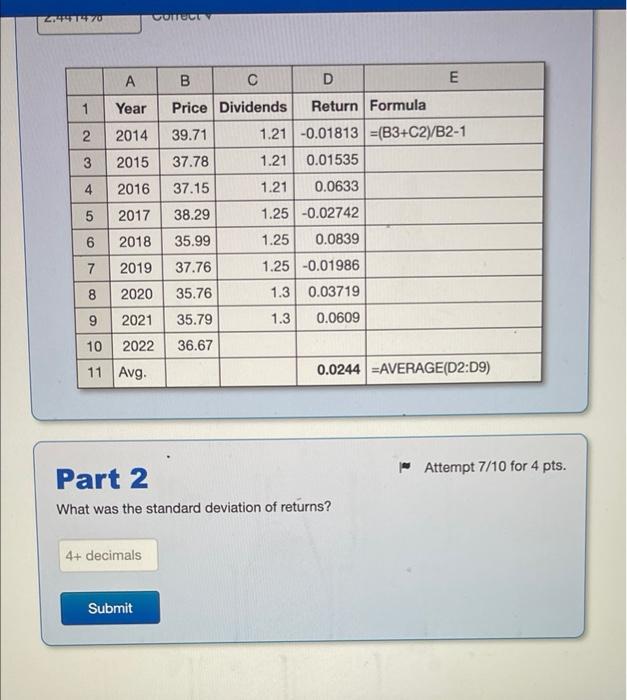

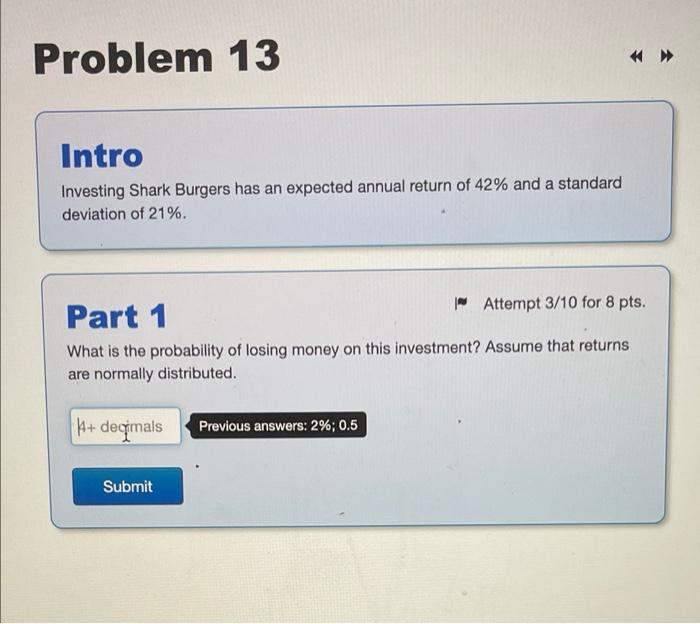

Problem 5 Intro The following table shows historical beginning-of-year prices for a stock and the sum of dividends paid throughout the year. B Price Dividends 39.71 1.21 37.78 1.21 1.21 1 Year 2 2014 3 2015 4 2016 5 2017 6 2018 72019 8 2020 9 2021 10 2022 1.25 37.15 38.29 35.99 37.76 1.25 1.25 1.3 35.76 35.79 36.67 1.3 - Attempt 2/10 for 9 pts. Part 1 What was the arithmetic average annual return? 2.4414% Correct A B CT D E 2470 DOM A 1 Year B D E Price Dividends Return Formula 39.71 1.21 -0.01813 =(B3+C2)/B2-1 37.78 1.21 0.01535 2014 2 3 2015 4 4 2016 37.15 1.21 0.0633 5 an 2017 38.29 1.25 -0.02742 1.25 0.0839 6 35.99 2018 2019 7 1.25 -0.01986 37.76 35.76 00 1.3 0.03719 35.79 1.3 0.0609 8 2020 9 2021 10 2022 11 Avg. 36.67 0.0244 =AVERAGE(D2:09) Attempt 7/10 for 4 pts. Part 2 What was the standard deviation of returns? 4+ decimals Submit Problem 13 Intro Investing Shark Burgers has an expected annual return of 42% and a standard deviation of 21%. Part 1 | Attempt 3/10 for 8 pts. What is the probability of losing money on this investment? Assume that returns are normally distributed. A+ deqimals Previous answers: 2%; 0.5 Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts