Question: Problem 5 part a: A bond has three years to maturity and a coupon rate of 596. Its face value is $1,000 and its yield

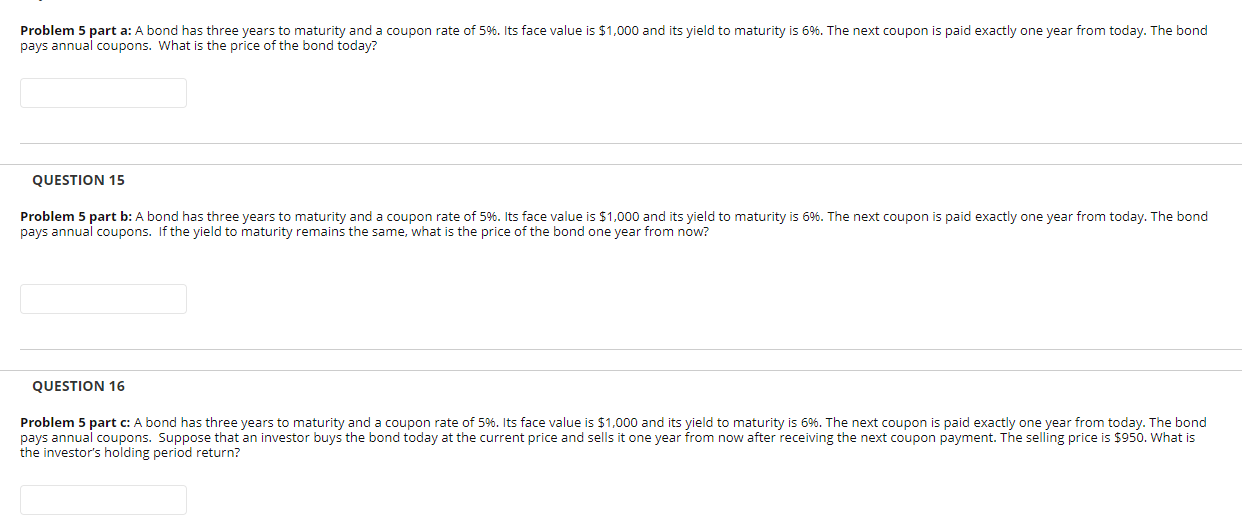

Problem 5 part a: A bond has three years to maturity and a coupon rate of 596. Its face value is $1,000 and its yield to maturity is 6%. The next coupon is paid exactly one year from today. The bond pays annual coupons. What is the price of the bond today? QUESTION 15 Problem 5 part b: A bond has three years to maturity and a coupon rate of 596. Its face value is $1,000 and its yield to maturity is 6%. The next coupon is paid exactly one year from today. The bond pays annual coupons. If the yield to maturity remains the same, what is the price of the bond one year from now? QUESTION 16 Problem 5 part c: A bond has three years to maturity and a coupon rate of 5%. Its face value is $1,000 and its yield to maturity is 6%. The next coupon is paid exactly one year from today. The bond pays annual coupons. Suppose that an investor buys the bond today at the current price and sells it one year from now after receiving the next coupon payment. The selling price is $950. What is the investor's holding period return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts