Question: Problem#7: YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 5 years, Coupon rate = 8%, Face value

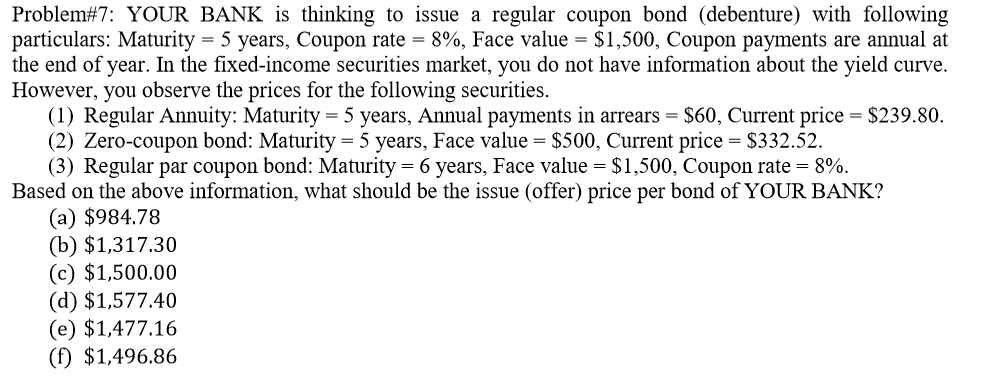

Problem#7: YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 5 years, Coupon rate = 8%, Face value = $1,500, Coupon payments are annual at the end of year. In the fixed-income securities market, you do not have information about the yield curve. However, you observe the prices for the following securities. (1) Regular Annuity: Maturity = 5 years, Annual payments in arrears = $60, Current price = $239.80. (2) Zero-coupon bond: Maturity = 5 years, Face value = $500, Current price = $332.52. (3) Regular par coupon bond: Maturity = 6 years, Face value = $1,500, Coupon rate = 8%. Based on the above information, what should be the issue (offer) price per bond of YOUR BANK? (a) $984.78 (b) $1,317.30 (c) $1,500.00 (d) $1,577.40 (e) $1,477.16 (f) $1,496.86 Problem#7: YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 5 years, Coupon rate = 8%, Face value = $1,500, Coupon payments are annual at the end of year. In the fixed-income securities market, you do not have information about the yield curve. However, you observe the prices for the following securities. (1) Regular Annuity: Maturity = 5 years, Annual payments in arrears = $60, Current price = $239.80. (2) Zero-coupon bond: Maturity = 5 years, Face value = $500, Current price = $332.52. (3) Regular par coupon bond: Maturity = 6 years, Face value = $1,500, Coupon rate = 8%. Based on the above information, what should be the issue (offer) price per bond of YOUR BANK? (a) $984.78 (b) $1,317.30 (c) $1,500.00 (d) $1,577.40 (e) $1,477.16 (f) $1,496.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts