Question: Problem 5 ( Recommended: review slides 6 5 - 7 0 ) Alpha acquired ( 7 0 % ) of Beta's shares

Problem Recommended: review slides

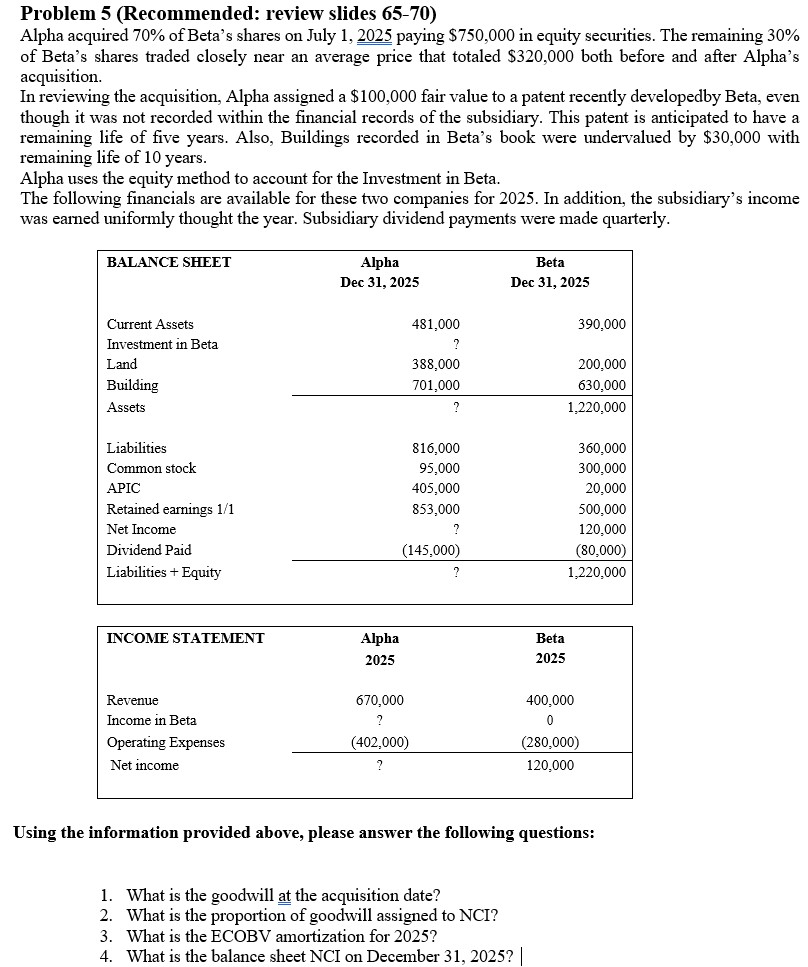

Alpha acquired of Beta's shares on July underline paying $ in equity securities The remaining of Beta's shares traded closely near an average price that totaled $ both before and after Alpha's acquisition.

In reviewing the acquisition, Alpha assigned a $ fair value to a patent recently developedby Beta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. Also, Buildings recorded in Beta's book were undervalued by $ with remaining life of years.

Alpha uses the equity method to account for the Investment in Beta.

The following financials are available for these two companies for In addition, the subsidiary's income was earned uniformly thought the year. Subsidiary dividend payments were made quarterly.

Using the information provided above, please answer the following questions:

What is the goodwill at the acquisition date?

What is the proportion of goodwill assigned to NCI

What is the ECOBV amortization for

What is the balance sheet NCI on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock