Question: Problem 5 ( recommended: Review slides 7 3 - 8 3 ) Hoyle, Schaefer and Doupnik - Chapter 3 Problem 2 9 Following are separate

Problem recommended: Review slides

Hoyle, Schaefer and Doupnik Chapter Problem

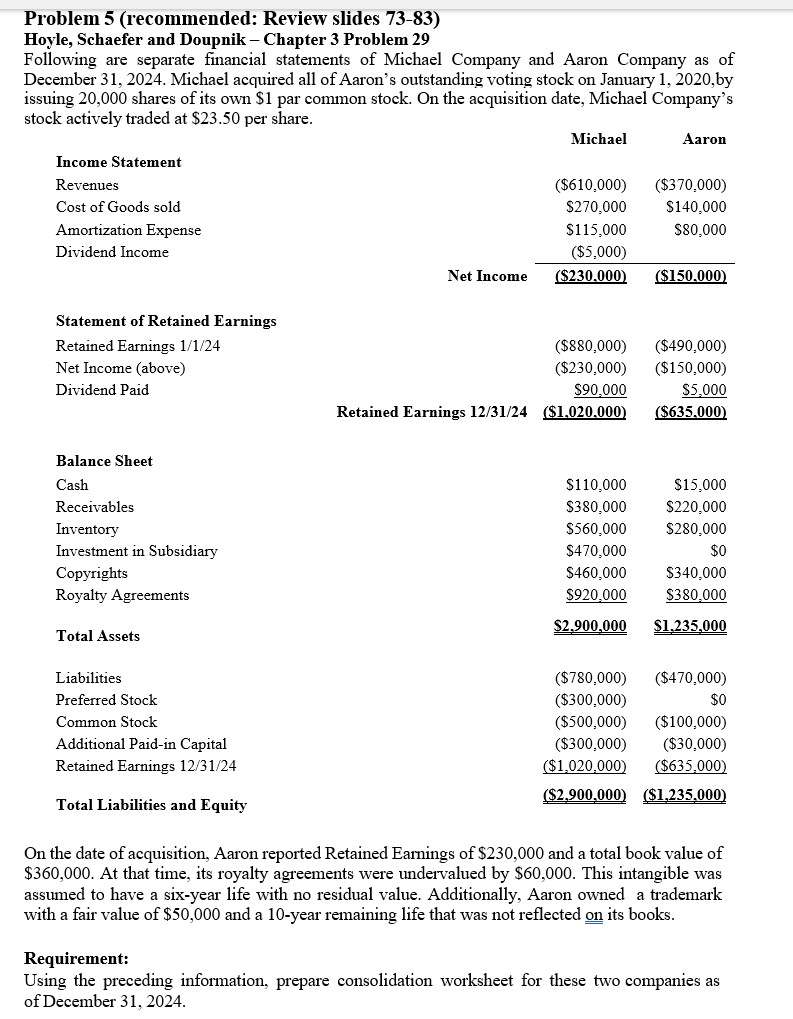

Following are separate financial statements of Michael Company and Aaron Company as of December Michael acquired all of Aaron's outstanding voting stock on January by issuing shares of its own $ par common stock. On the acquisition date, Michael Company's stock actively traded at $ per share.

On the date of acquisition, Aaron reported Retained Earnings of $ and a total book value of $ At that time, its royalty agreements were undervalued by $ This intangible was assumed to have a sixyear life with no residual value. Additionally, Aaron owned a trademark with a fair value of $ and a year remaining life that was not reflected on its books.

Requirement:

Using the preceding information, prepare consolidation worksheet for these two companies as of December begintabularcccccc

hline multirowbAccount & multirowbParent & multirowbSubsidiary & multicolumnlConsolidation Entries & multirowtbegintabularl

Consolid.

Totals

endtabular

hline & & & Debits & Credits &

hline multicolumnlIncome Statement & & &

hline Revenues & $ & $ & & &

hline Cost of Goods Sold & $ & $ & & &

hline Amortization Expenses & $ & $ & & &

hline Dividend Income & $ & & & &

hline Net Income & $ & $ & & &

hline multicolumnlStatement of Retained Earnings & & &

hline Retained Earnings & $ & $ & & &

hline Net Income above & $ & $ & & &

hline Dividend Paid & $ & $ & & &

hline Retained Earnings & $ & $ & & &

hline & & & & &

hline multicolumnlBalance Sheet & & &

hline Cash & $ & $ & & &

hline Receivables & $ & $ & & &

hline Inventory & $ & $ & & &

hline Investment in Subsidiary & $ & $ & & &

hline Copyrights & $ & $ & & &

hline Royalty Agreements & $ & $ & & &

hline Total Assets & $ & $ & & &

hline & & & & &

hline Liabilities & $ & $ & & &

hline Preferred Stocks & $ & $ & & &

hline Common Stock & $ & $ & & &

hline Additional Paidin Capital & $ & $ & & &

hline Retained Earnings & $ & $ & & &

hline Total Liabilities and Equity & $ & $ & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock