Question: Problem 5 Suppose you can establish that for the each annual cash flow of the venture described in problem 8, the correlation between project cash

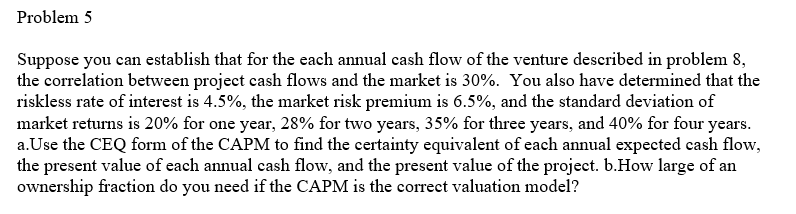

Problem 5 Suppose you can establish that for the each annual cash flow of the venture described in problem 8, the correlation between project cash flows and the market is 30%. You also have determined that the riskless rate of interest is 4.5%, the market risk premium is 6.5%, and the standard deviation of market returns is 20% for one year, 28% for two years, 35% for three years, and 40% for four years. a.Use the CEQ form of the CAPM to find the certainty equivalent of each annual expected cash flow, the present value of each annual cash flow, and the present value of the project. b.How large of an ownership fraction do you need if the CAPM is the correct valuation model? Problem 5 Suppose you can establish that for the each annual cash flow of the venture described in problem 8, the correlation between project cash flows and the market is 30%. You also have determined that the riskless rate of interest is 4.5%, the market risk premium is 6.5%, and the standard deviation of market returns is 20% for one year, 28% for two years, 35% for three years, and 40% for four years. a.Use the CEQ form of the CAPM to find the certainty equivalent of each annual expected cash flow, the present value of each annual cash flow, and the present value of the project. b.How large of an ownership fraction do you need if the CAPM is the correct valuation model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts