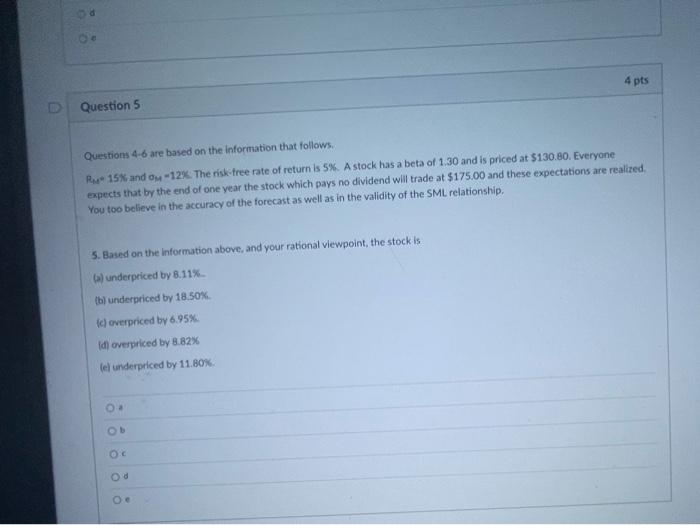

Question: 4 pts Question 5 Questions 4-6 are based on the information that follows R-15% and ow -12%. The risk tree rate of return is 5%.

4 pts Question 5 Questions 4-6 are based on the information that follows R-15% and ow -12%. The risk tree rate of return is 5%. A stock has a beta of 1.30 and is priced at $130.80. Everyone expects that by the end of one year the stock which pays no dividend will trade at $175.00 and these expectations are realized, You too believe in the accuracy of the forecast as well as in the validity of the SML relationship, 5. Based on the Information above, and your rational viewpoint, the stock is 6) underpriced by 8.11% (b) underpriced by 18.50% Id overpriced by 6.95% Idoverpriced by 8.82% lel underpriced by 11.80% O Od O

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock