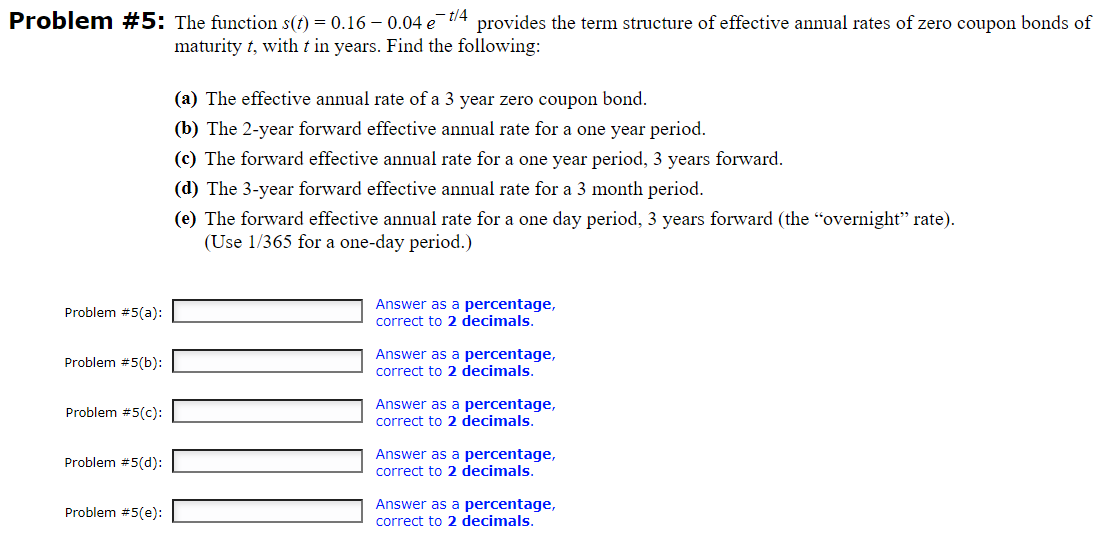

Question: Problem #5: The function s(t) = 0.16 -0.04 e 1/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t,

Problem #5: The function s(t) = 0.16 -0.04 e 1/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t, with t in years. Find the following: (a) The effective annual rate of a 3 year zero coupon bond. (b) The 2-year forward effective annual rate for a one year period. (c) The forward effective annual rate for a one year period, 3 years forward. (d) The 3-year forward effective annual rate for a 3 month period. (e) The forward effective annual rate for a one day period, 3 years forward (the "overnight rate). (Use 1/365 for a one-day period.) Problem #5(a): Answer as a percentage, correct to 2 decimals. Problem #5(b): Answer as a percentage, correct to 2 decimals. Problem #5(c): Answer as a percentage, correct to 2 decimals. Problem #5(d): Answer as a percentage, correct to 2 decimals. Problem #5(e): Answer as a percentage, correct to 2 decimals. Problem #5: The function s(t) = 0.16 -0.04 e 1/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t, with t in years. Find the following: (a) The effective annual rate of a 3 year zero coupon bond. (b) The 2-year forward effective annual rate for a one year period. (c) The forward effective annual rate for a one year period, 3 years forward. (d) The 3-year forward effective annual rate for a 3 month period. (e) The forward effective annual rate for a one day period, 3 years forward (the "overnight rate). (Use 1/365 for a one-day period.) Problem #5(a): Answer as a percentage, correct to 2 decimals. Problem #5(b): Answer as a percentage, correct to 2 decimals. Problem #5(c): Answer as a percentage, correct to 2 decimals. Problem #5(d): Answer as a percentage, correct to 2 decimals. Problem #5(e): Answer as a percentage, correct to 2 decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts