Question: Problem #5: The function s(t) = 0.1 -0.03 e 1/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t,

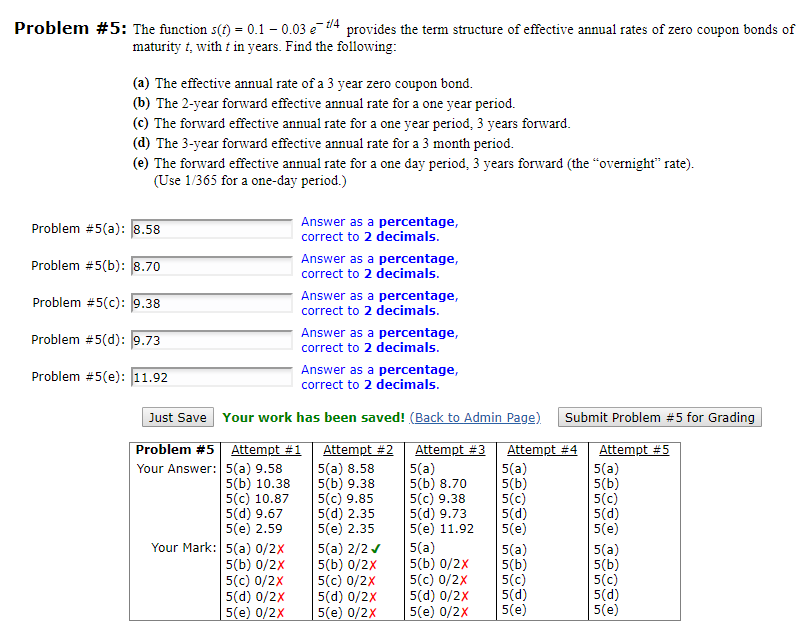

Problem #5: The function s(t) = 0.1 -0.03 e 1/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t, with t in years. Find the following: (a) The effective annual rate of a 3 year zero coupon bond. (b) The 2-year forward effective annual rate for a one year period. ) The forward effective annual rate for a one year period, 3 years forward. (d) The 3-year forward effective annual rate for a 3 month period. (e) The forward effective annual rate for a one day period, 3 years forward (the overnight rate). (Use 1/365 for a one-day period.) Problem #5(a): 8.58 Problem #5(b): 8.70 Problem #5(c): 9.38 Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Problem #5(d): 9.73 Problem #5(e): 11.92 Just Save Your work has been saved! (Back to Admin Page) Submit Problem #5 for Grading Problem #5 Attempt #1 Your Answer: 5(a) 9.58 5(b) 10.38 5(c) 10.87 5(d) 9.67 5(e) 2.59 Your Mark: 5(a) 0/2X 5(b) 0/2x 5(c) 0/2x 5(d) 0/2x 5(e) 0/2x Attempt #2 5(a) 8.58 5(b) 9.38 5(c) 9.85 5(d) 2.35 5(e) 2.35 5(a) 2/2 5(b) 0/2x 5(C) 0/2 x 5(d) 0/2x 5(e) 0/2 Attempt #3 5(a) 5(b) 8.70 5(c) 9.38 5(d) 9.73 5(e) 11.92 5(a) 5(b) 0/2x 5(c) 0/2x 5(d) 0/2x 5(e) 0/2x Attempt #4 5(a) 5(b) 5(c) 5(d) 5(e) 5(a) 5(b) 5(0) 5(d) 5(e) Attempt #5 5(a) 5(b) 5(0) 5(d) 5(e) 5(a) 5(b) 5(0) 5(d) 5(e) Problem #5: The function s(t) = 0.1 -0.03 e 1/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t, with t in years. Find the following: (a) The effective annual rate of a 3 year zero coupon bond. (b) The 2-year forward effective annual rate for a one year period. ) The forward effective annual rate for a one year period, 3 years forward. (d) The 3-year forward effective annual rate for a 3 month period. (e) The forward effective annual rate for a one day period, 3 years forward (the overnight rate). (Use 1/365 for a one-day period.) Problem #5(a): 8.58 Problem #5(b): 8.70 Problem #5(c): 9.38 Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Answer as a percentage, correct to 2 decimals. Problem #5(d): 9.73 Problem #5(e): 11.92 Just Save Your work has been saved! (Back to Admin Page) Submit Problem #5 for Grading Problem #5 Attempt #1 Your Answer: 5(a) 9.58 5(b) 10.38 5(c) 10.87 5(d) 9.67 5(e) 2.59 Your Mark: 5(a) 0/2X 5(b) 0/2x 5(c) 0/2x 5(d) 0/2x 5(e) 0/2x Attempt #2 5(a) 8.58 5(b) 9.38 5(c) 9.85 5(d) 2.35 5(e) 2.35 5(a) 2/2 5(b) 0/2x 5(C) 0/2 x 5(d) 0/2x 5(e) 0/2 Attempt #3 5(a) 5(b) 8.70 5(c) 9.38 5(d) 9.73 5(e) 11.92 5(a) 5(b) 0/2x 5(c) 0/2x 5(d) 0/2x 5(e) 0/2x Attempt #4 5(a) 5(b) 5(c) 5(d) 5(e) 5(a) 5(b) 5(0) 5(d) 5(e) Attempt #5 5(a) 5(b) 5(0) 5(d) 5(e) 5(a) 5(b) 5(0) 5(d) 5(e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts