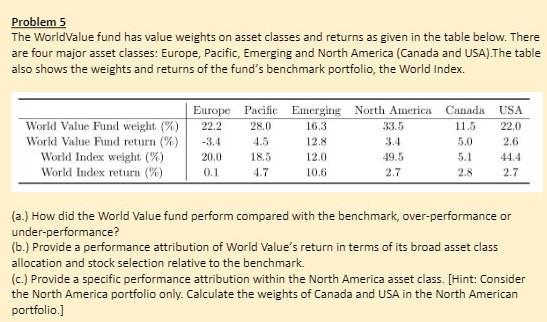

Question: Problem 5 The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes:

Problem 5 The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe, Pacific, Emerging and North America Canada and USA).The table also shows the weights and returns of the fund's benchmark portfolio, the World Index. World Value Fund weight (%) World Value Fund return (%) World Index weight (%) World Index return (%) Europe Pacific Emerging North America Canada USA 22.2 28.0 16.3 33.5 11.5 22.0 -3.4 12.8 3.4 5.0 2.6 20,0 18.5 12.0 49.5 5.1 44.4 0.1 1.7 10.6 2.7 2.8 2.7 (a.) How did the World Value fund perform compared with the benchmark, over-performance or under-performance? (5.) Provide a performance attribution of World Value's return in terms of its broad asset class allocation and stock selection relative to the benchmark. (c.) Provide a specific performance attribution within the North America asset class. (Hint: Consider the North America portfolio only. Calculate the weights of Canada and USA in the North American portfolio.] Problem 5 The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe, Pacific, Emerging and North America Canada and USA).The table also shows the weights and returns of the fund's benchmark portfolio, the World Index. World Value Fund weight (%) World Value Fund return (%) World Index weight (%) World Index return (%) Europe Pacific Emerging North America Canada USA 22.2 28.0 16.3 33.5 11.5 22.0 -3.4 12.8 3.4 5.0 2.6 20,0 18.5 12.0 49.5 5.1 44.4 0.1 1.7 10.6 2.7 2.8 2.7 (a.) How did the World Value fund perform compared with the benchmark, over-performance or under-performance? (5.) Provide a performance attribution of World Value's return in terms of its broad asset class allocation and stock selection relative to the benchmark. (c.) Provide a specific performance attribution within the North America asset class. (Hint: Consider the North America portfolio only. Calculate the weights of Canada and USA in the North American portfolio.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts