Question: Problem 5 The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes:

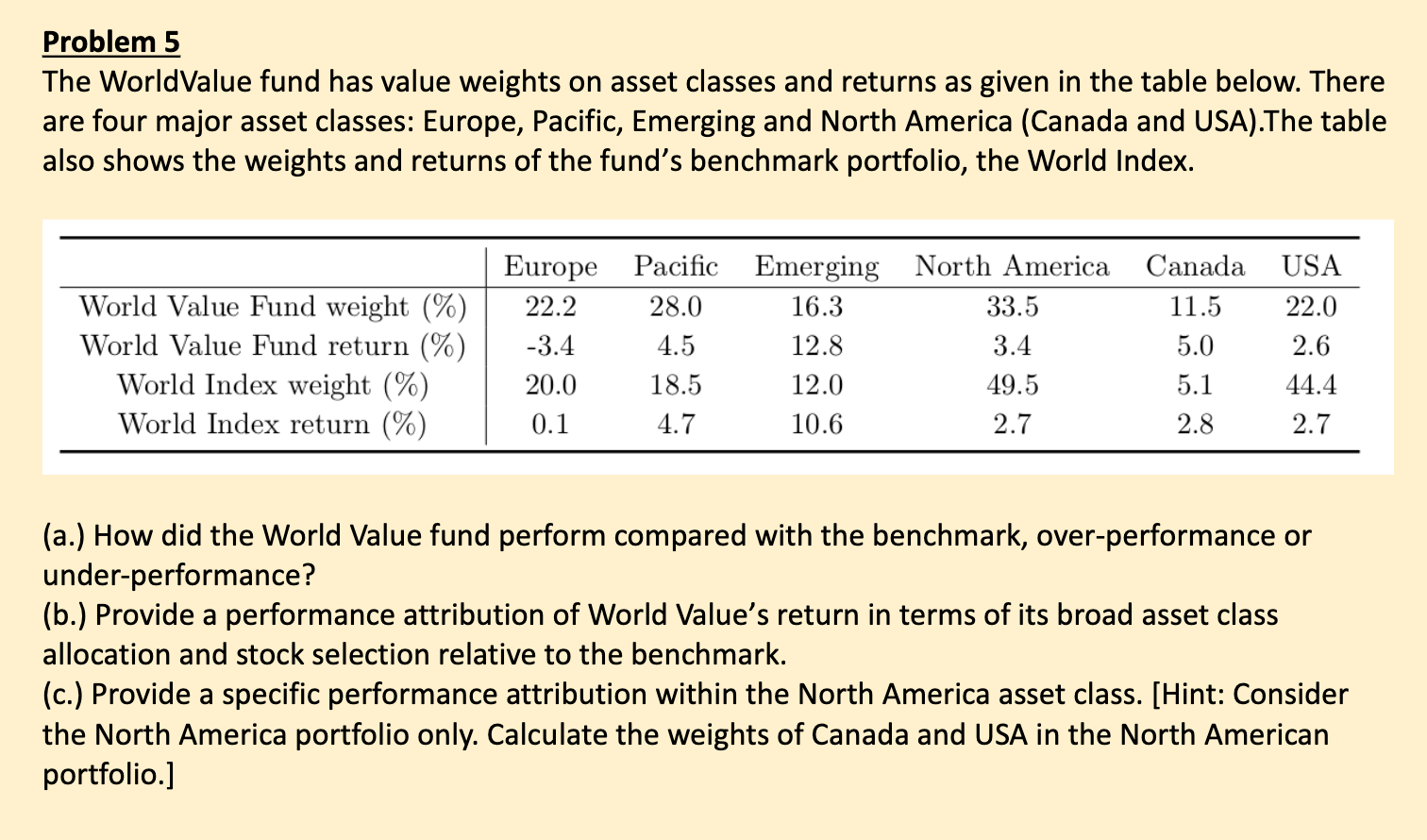

Problem 5 The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe, Pacific, Emerging and North America (Canada and USA). The table also shows the weights and returns of the fund's benchmark portfolio, the World Index. Europe Pacific Emerging North America Canada USA World Value Fund weight (%) 22.2 28.0 16.3 33.5 11.5 22.0 World Value Fund return (%) -3.4 4.5 12.8 3.4 5.0 2.6 World Index weight (%) 20.0 18.5 12.0 49.5 5.1 44.4 World Index return (%) 0.1 4.7 10.6 2.7 2.8 2.7 (a.) How did the World Value fund perform compared with the benchmark, over-performance or under-performance? (b.) Provide a performance attribution of World Value's return in terms of its broad asset class allocation and stock selection relative to the benchmark. (c.) Provide a specific performance attribution within the North America asset class. [Hint: Consider the North America portfolio only. Calculate the weights of Canada and USA in the North American portfolio.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts