Question: Problem # 5: WACC Calculations. 15 marks ABC Corporation has 9 million shares of common stock outstanding, .S million shares of 6 percent preferred stock

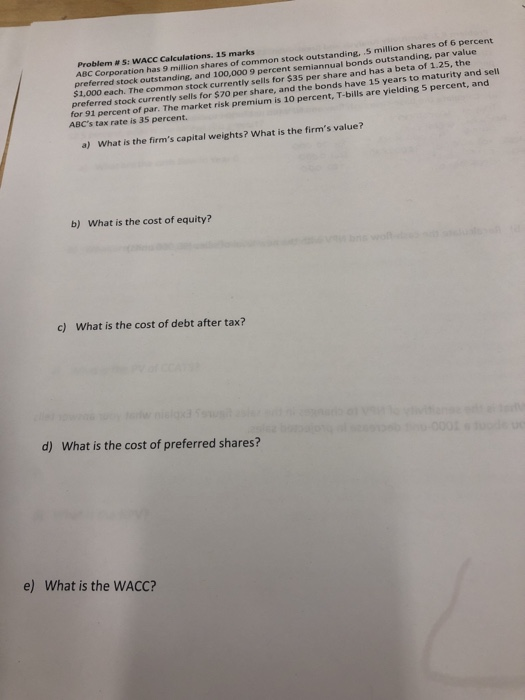

Problem # 5: WACC Calculations. 15 marks ABC Corporation has 9 million shares of common stock outstanding, .S million shares of 6 percent preferred stock outstanding, and 100,000 9 percent semiannual bonds outstanding. par value $1,000 each. The common stock currently sells for $35 per share and has a beta of 1.25, the preferred stock currently sells for $70 per share, and the bonds have 15 years to maturity and sell for 91 percent of par. The market risk premium is 10 percent, T-bills are yielding 5 percent, and ABC's tax rate is 35 percent. a) What is the firm's capital weights? What is the firm's valuei? b) What is the cost of equity? c) What is the cost of debt after tax? d) What is the cost of preferred shares? e) What is the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts