Question: Problem 5-40 Calculating Annuity Present Values [LO 2] You want to borrow $63,000 from your local bank to buy a new sailboat. You can afford

![Problem 5-40 Calculating Annuity Present Values [LO 2] You want to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd54c15a9e2_33666fd54c0e208b.jpg)

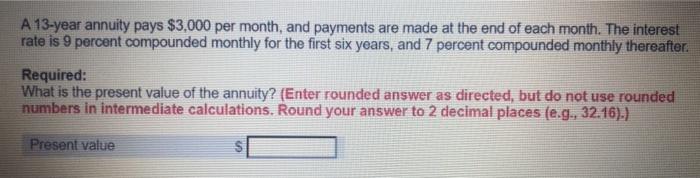

Problem 5-40 Calculating Annuity Present Values [LO 2] You want to borrow $63,000 from your local bank to buy a new sailboat. You can afford to make monthly payments of $1,200, but no more. Required: Assuming monthly compounding, what is the highest rate you can afford on a 66-month APR loan? (Round your answer as directed, but do not use rounded numbers in intermediate calculations. Enter your answer as a percent rounded to 2 decimal places (e.g., 32.16).) Highest rate A 13-year annuity pays $3,000 per month, and payments are made at the end of each month. The interest rate is 9 percent compounded monthly for the first six years, and 7 percent compounded monthly thereafter. Required: What is the present value of the annuity? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Present value S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts