Question: Problem 5-9 Using the Table 5.4 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if

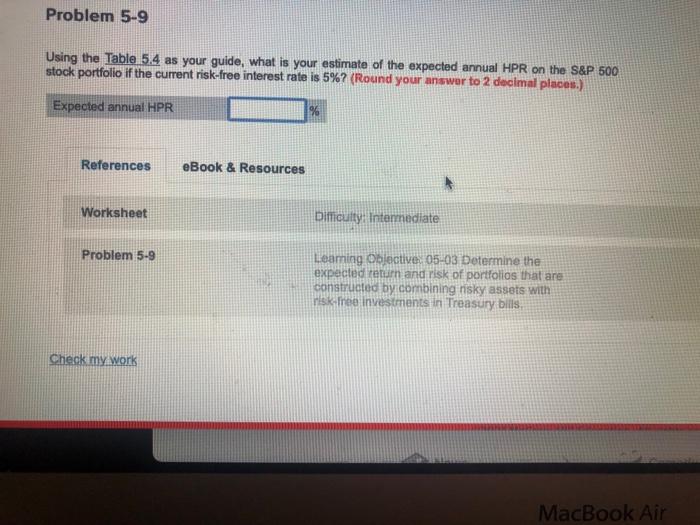

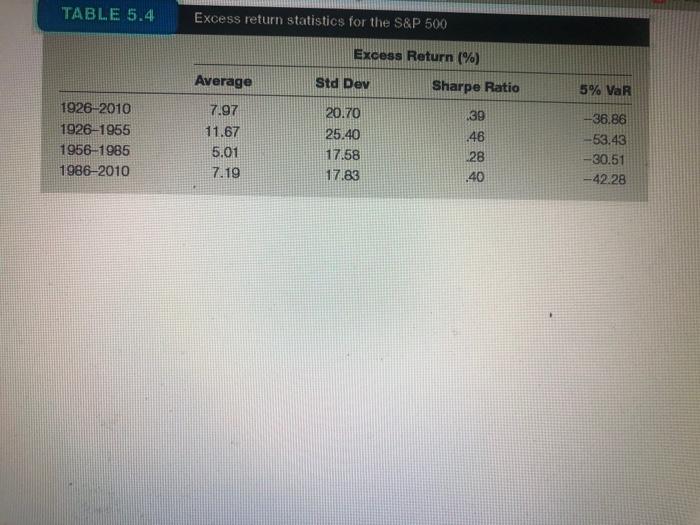

Problem 5-9 Using the Table 5.4 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free interest rate is 5%? (Round your answer to 2 decimal places.) Expected annual HPR % References eBook & Resources Worksheet Difficulty Intermediate Problem 5-9 Leaming Objective: 05-03 Determine the expected return and risk of portfolios that are constructed by combining risky assets with risk free investments in Treasury bills Check my work MacBook Air TABLE 5.4 Excess return statistics for the S&P 500 Excess Return (%) Average Std Dev Sharpe Ratio 5% VaR 1926-2010 1926-1955 1956-1985 1986-2010 7.97 11.67 5.01 7.19 20.70 25.40 17.58 17.83 139 .46 28 40 -36.86 -53.43 -30.51 -42.28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts