Question: Problem 6 (15 points) Consider three bonds A,B and C. All these three bonds have 3-year maturity with face value of $1000. Bond A pays

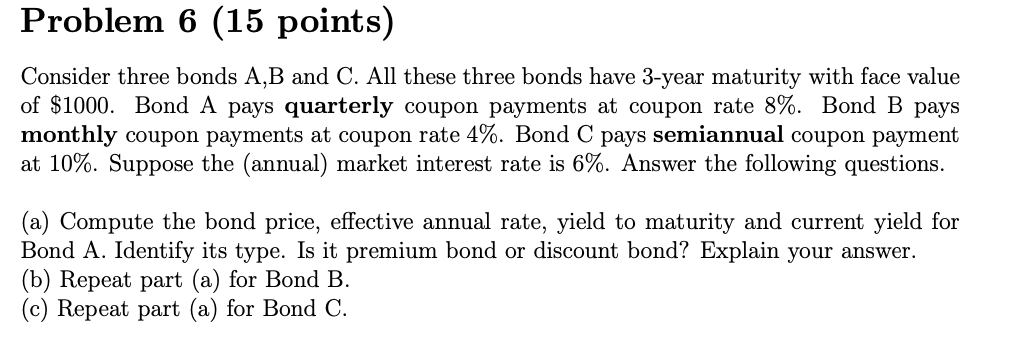

Problem 6 (15 points) Consider three bonds A,B and C. All these three bonds have 3-year maturity with face value of $1000. Bond A pays quarterly coupon payments at coupon rate 8%. Bond B pays monthly coupon payments at coupon rate 4%. Bond C pays semiannual coupon payment at 10%. Suppose the (annual) market interest rate is 6%. Answer the following questions. (a) Compute the bond price, effective annual rate, yield to maturity and current yield for Bond A. Identify its type. Is it premium bond or discount bond? Explain your answer. (b) Repeat part (a) for Bond B. (C) Repeat part (a) for Bond C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts