Question: Question 12 Question 13 Consider three bonds, A, B, and C, each paying 7% semiannual coupons, and with face value of USD 1.000. For each

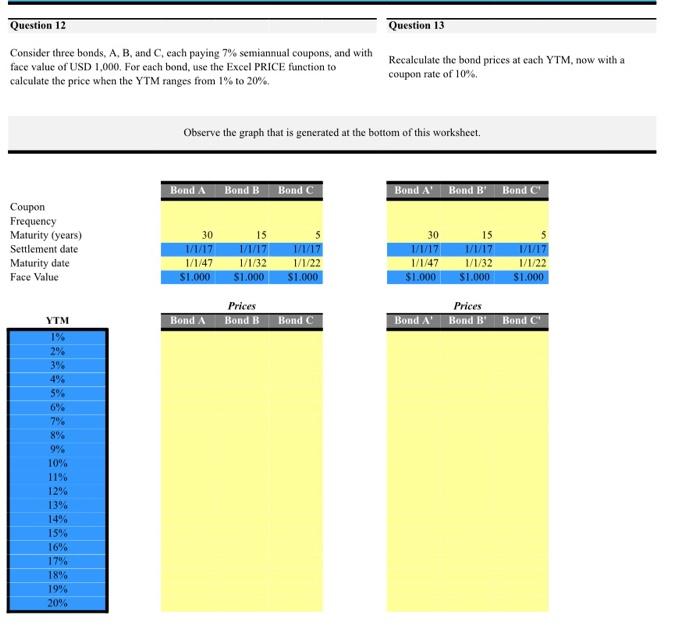

Question 12 Question 13 Consider three bonds, A, B, and C, each paying 7% semiannual coupons, and with face value of USD 1.000. For each bond, use the Excel PRICE function to calculate the price when the YTM ranges from 1% to 20%. Recalculate the bond prices at each YTM, now with a coupon rate of 10% Observe the graph that is generated at the bottom of this worksheet. Bond A Bond B Bond C Bond A' Bond B' Bond C Coupon Frequency Maturity (years) Settlement date Maturity date Face Value 30 1/1/17 1/1/47 S1.000 15 1/1/17 1/1/32 $1.000 1/1/17 1/1/22 $1.000 30 1/1/17 1/1/47 $1.000 15 1/1/17 1/1/32 $1.000 11/17 1/1/22 $1.000 Prices Bond A Bond B Bond C Prices Bond A' Bond B Bond" YTM 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1196 1296 13% 14% 15% 16% 17% 18% 19% 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts