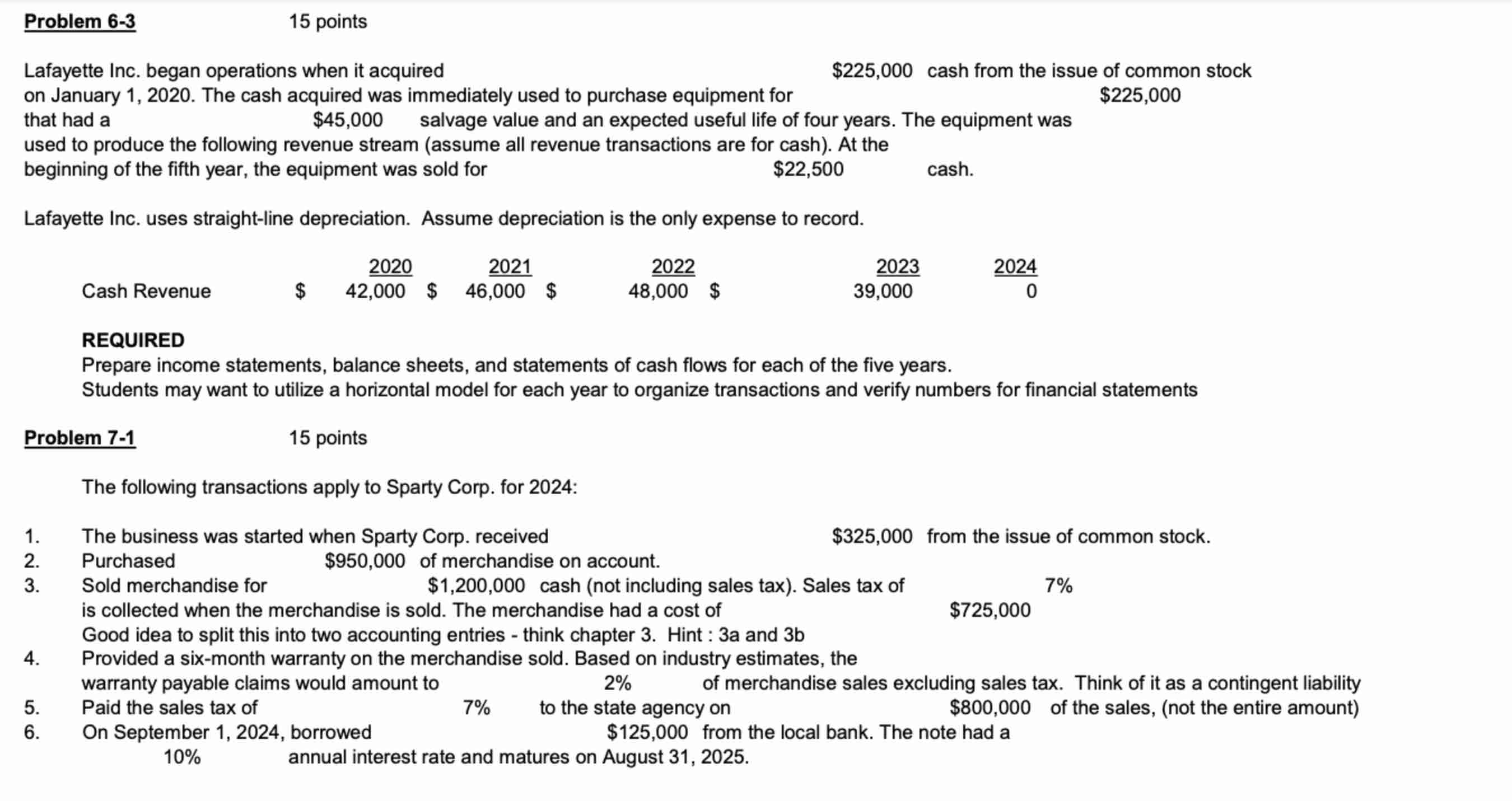

Question: Problem 6 - 3 1 5 points Lafayette Inc. began operations when i t acquired $ 2 2 5 , 0 0 0 cash from

Problem

points

Lafayette Inc. began operations when acquired

$ cash from the issue common stock

January The cash acquired was immediately used purchase equipment for

$

that had

$ salvage value and expected useful life four years. The equipment was

used produce the following revenue stream all revenue transactions are for cash the

beginning the fifth year, the equipment was sold for

$

cash.

Lafayette Inc. uses straightline depreciation. Assume depreciation the only expense record.

Cash Revenue

$$

REQUIRED

Prepare income statements, balance sheets, and statements cash flows for each the five years.

Students may want utilize a horizontal model for each year organize transactions and verify numbers for financial statements

Problem

points

The following transactions apply Sparty Corp. for :

The business was started when Sparty Corp. received

$ from the issue common stock.

Purchased $ merchandise account.

Sold merchandise for

$ cash including sales tax Sales tax

collected when the merchandise sold. The merchandise had a cost

$

Good idea split this into two accounting entries think chapter Hint: a and

Provided a sixmonth warranty the merchandise sold. Based industry estimates, the

warranty payable claims would amount

merchandise sales excluding sales tax. Think a contingent liability

Paid the sales tax

$ the sales, the entire amount

September borrowed

$ from the local bank. The note had

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock