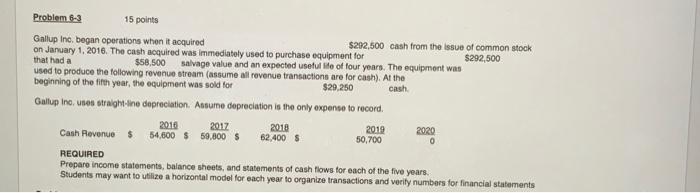

Question: Problem 6-3 15 points Gallup Inc. began operations when it acquired on January 1, 2016. The cash acquired was immediately used to purchase equipment for

Gallup Inc, began operations when it acquired on January 1, 2016. The cash acquired was immediately used to purchase equipment for that had a $58,500 salvage value and an expected useful lifo of four years. The equipment was used to produce the following revenue stream (assume all rovenue transactions are for cash). At the beginning of the fifth year, the equipment was sold for $29.250 cash. Gallup inc, uses strabhtine depreciation. Assume depreciation is the only expense to record. REQUIAED Preparo income statements, balance sheets, and statements of cash flows for each of the five years. Students may want to utilize a horizontal model for each year to organize transactions and verify numbers for financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts