Question: Problem 6 - 4 2 ( Algorithmic ) ( LO . 3 ) Henrietta, the owner of a very successful hotel chain in the Southeast,

Problem AlgorithmicLO

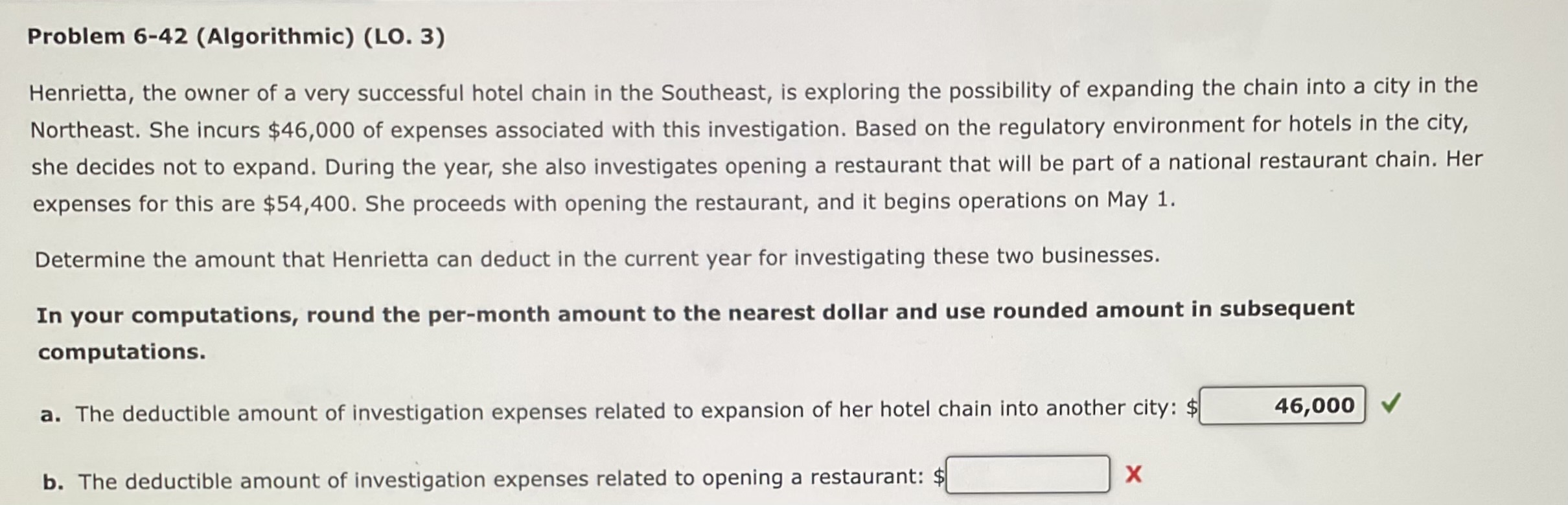

Henrietta, the owner of a very successful hotel chain in the Southeast, is exploring the possibility of expanding the chain into a city in the Northeast. She incurs $ of expenses associated with this investigation. Based on the regulatory environment for hotels in the city, she decides not to expand. During the year, she also investigates opening a restaurant that will be part of a national restaurant chain. Her expenses for this are $ She proceeds with opening the restaurant, and it begins operations on May

Determine the amount that Henrietta can deduct in the current year for investigating these two businesses.

In your computations, round the permonth amount to the nearest dollar and use rounded amount in subsequent computations.

a The deductible amount of investigation expenses related to expansion of her hotel chain into another city: $

b The deductible amount of investigation expenses related to opening a restaurant: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock