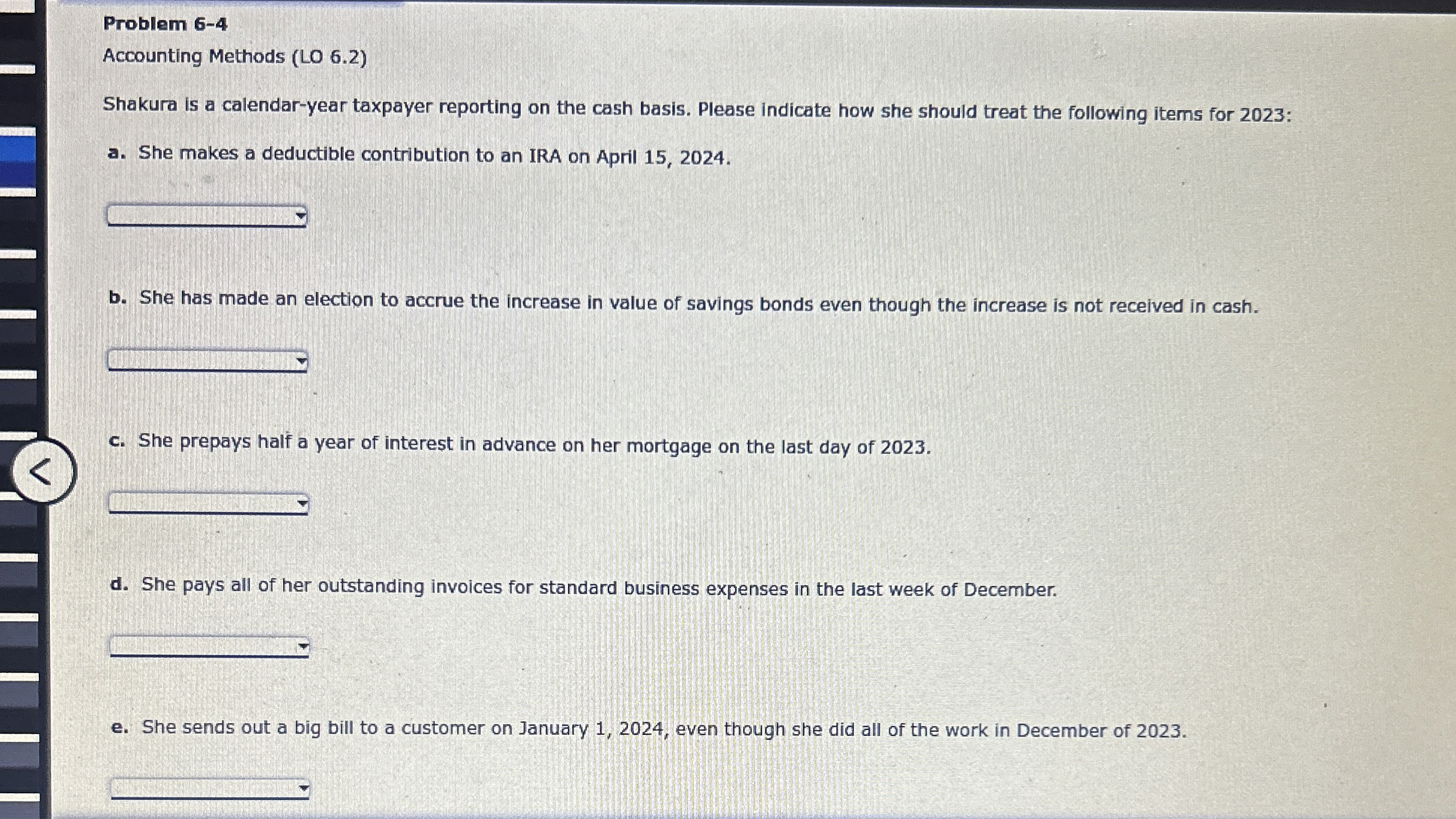

Question: Problem 6 - 4 Accounting Methods ( LO 6 . 2 ) Shakura is a calendar - year taxpayer reporting on the cash basis. Please

Step by Step Solution

There are 3 Steps involved in it

Based on the question provided in the image here is how Shakura a calendaryear taxpayer reporting on the cash basis should treat the following items f... View full answer

Get step-by-step solutions from verified subject matter experts