Question: Problem 6. (5 points) Let X1 be a random variable denoting the return of stock 1, and X2 be a random variable denoting the return

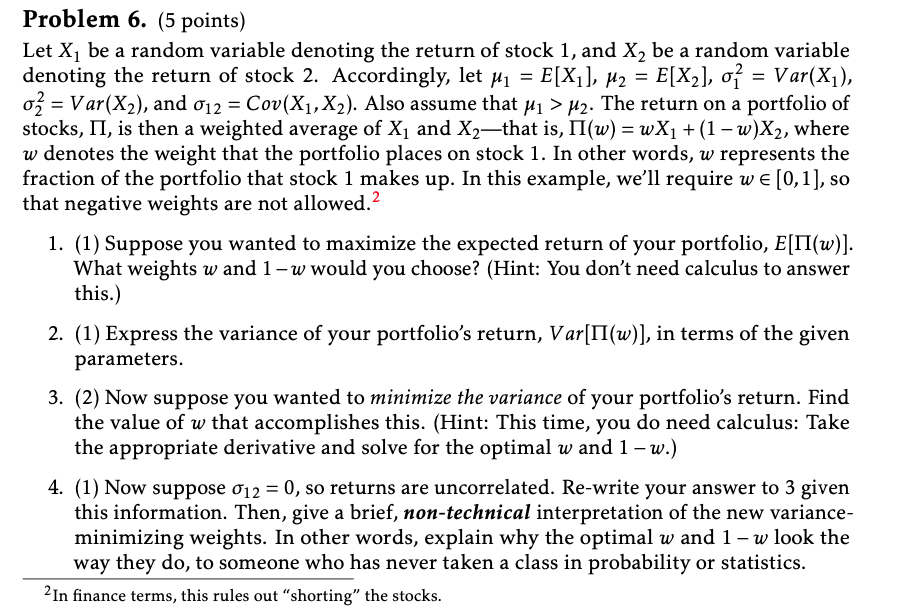

Problem 6. (5 points) Let X1 be a random variable denoting the return of stock 1, and X2 be a random variable denoting the return of stock 2. Accordingly, let ,u] = E[X1], p2 = E[X2], 0'12 = Vat-(X1), of = Var-{X2}, and on = C01) (X1,X2). Also assume that M > m. The return on a portfolio of stocks, 1'1, is then a weighted average of X1 and Xzthat is, \"(It-7) = 10X; + (1 w)X2, where w denotes the weight that the portfolio places on stock 1 . In other words, It) represents the fraction of the portfolio that stock 1 makes up. In this example, we'll require 10 e [0, 1], so that negative weights are not allowed?- 1. (1) Suppose you wanted to maximize the expected return of your portfolio, .E[1'I{w)]. What weights w and 1 w would you choose? (Hint: You don't need calculus to answer this.) 2. (1) Express the variance of your portfolio's return, Var[l'l{w)], in terms of the given parameters. 3. (2) Now suppose you wanted to minimize the variance of your portfolio's return. Find the value of to that accomplishes this. (Hint: This time, you do need calculus: Take the appropriate derivative and solve for the optimal w and 1 w.) 4. (1) Now suppose 0'12 = [1, so returns are uncorrelated. Re-write your answer to 3 given this information. Then, give a brief, non-technical interpretation of the new variance- minimizing weights. In other words, explain why the optimal to! and 1 to look the way they do, to someone who has never taken a class in probability or statistics. 2'In nance terms, this rules out "shorting\" the stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts