Question: PROBLEM 6 (50 points) You manage a grain storage elevator. It is January and you bought 30,000 bushels of com at $2.99/bu in the

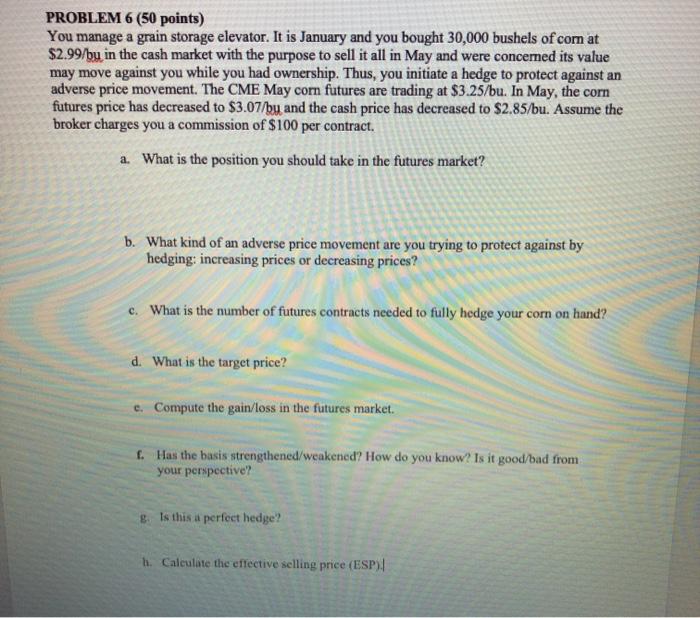

PROBLEM 6 (50 points) You manage a grain storage elevator. It is January and you bought 30,000 bushels of com at $2.99/bu in the cash market with the purpose to sell it all in May and were concerned its value may move against you while you had ownership. Thus, you initiate a hedge to protect against an adverse price movement. The CME May corn futures are trading at $3.25/bu. In May, the corn futures price has decreased to $3.07/by and the cash price has decreased to $2.85/bu. Assume the broker charges you a commission of $100 per contract. a. What is the position you should take in the futures market? b. What kind of an adverse price movement are you trying to protect against by hedging: increasing prices or decreasing prices? c. What is the number of futures contracts needed to fully hedge your corn on hand? d. What is the target price? e. Compute the gain/loss in the futures market. f. Has the basis strengthened/weakened? How do you know? Is it good/bad from your perspective? g. Is this a perfect hedge? h. Calculate the effective selling price (ESP)|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts