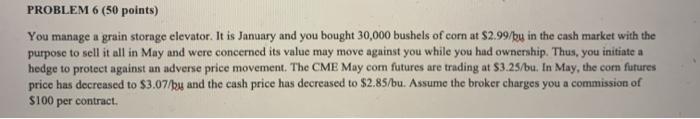

Question: PROBLEM 6 (50 points) You manage n grain storage elevator. It is January and you bought 30,000 bushels of corn at $2.99/by in the cash

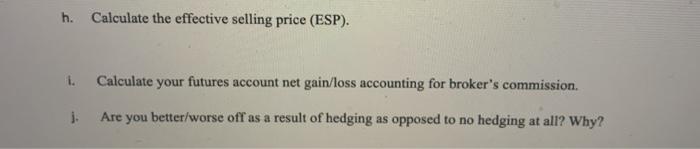

PROBLEM 6 (50 points) You manage n grain storage elevator. It is January and you bought 30,000 bushels of corn at $2.99/by in the cash market with the purpose to sell it all in May and were concerned its value may move against you while you had ownership. Thus, you initiate a hedge to protect against an adverse price movement. The CME May com futures are trading at $3.25/bu. In May, the corn futures price has decreased to $3.07/by and the cash price has decreased to $2.85/bu. Assume the broker charges you a commission of $100 per contract h. Calculate the effective selling price (ESP). 1. Calculate your futures account net gain/loss accounting for broker's commission. i. Are you better/worse off as a result of hedging as opposed to no hedging at all? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts