Question: Problem 6 A company with a MARR = 10% is considering the three options shown. Option 3 is the Do Nothing option Option 1 Option

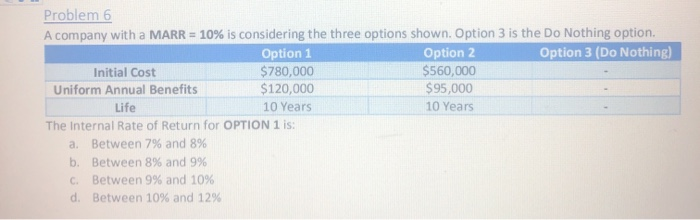

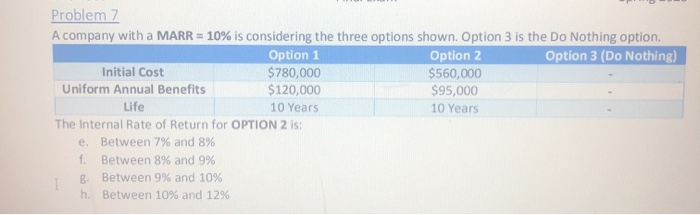

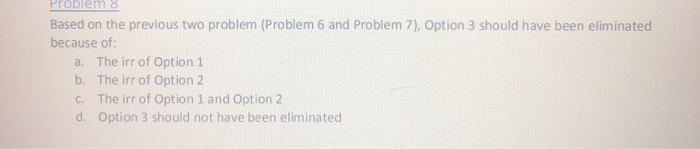

Problem 6 A company with a MARR = 10% is considering the three options shown. Option 3 is the Do Nothing option Option 1 Option 2 Option 3 (Do Nothing) Initial Cost $780,000 $560,000 Uniform Annual Benefits $120,000 $95,000 Life 10 Years 10 Years The Internal Rate of Return for OPTION 1 is: a. Between 7% and 8% b. Between 8% and 9% C Between 9% and 10% d. Between 10% and 12% Problem 7 A company with a MARR = 10% is considering the three options shown. Option 3 is the Do Nothing option Option 1 Option 2 Option 3 (Do Nothing) Initial Cost $780,000 $560,000 Uniform Annual Benefits $120,000 $95,000 Life 10 Years 10 Years The Internal Rate of Return for OPTION 2 is: e. Between 7% and 8% Between 8% and 9% B. Between 9% and 10% h. Between 10% and 12% Problem 8 Based on the previous two problem (Problem 6 and Problem 7), Option 3 should have been eliminated because of: a. The irr of Option 1 b. The irr of Option 2 C. The irr of Option 1 and Option 2 d. Option 3 should not have been eliminated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts