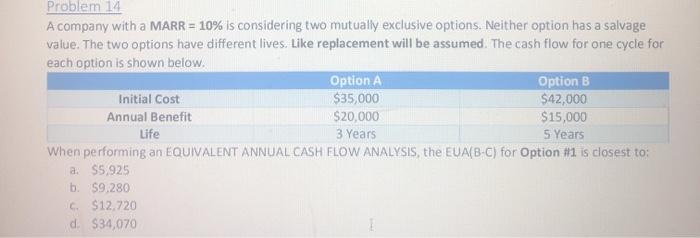

Question: Problem 14 A company with a MARR = 10% is considering two mutually exclusive options. Neither option has a salvage value. The two options have

Problem 14 A company with a MARR = 10% is considering two mutually exclusive options. Neither option has a salvage value. The two options have different lives. Like replacement will be assumed. The cash flow for one cycle for each option is shown below. Option A Option B Initial Cost $35,000 $42,000 Annual Benefit $20,000 $15,000 Life 3 Years 5 Years When performing an EQUIVALENT ANNUAL CASH FLOW ANALYSIS, the EUA(B-C) for Option #1 is closest to: a $5,925 b. $9,280 C. $12,720 d. $34,070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts