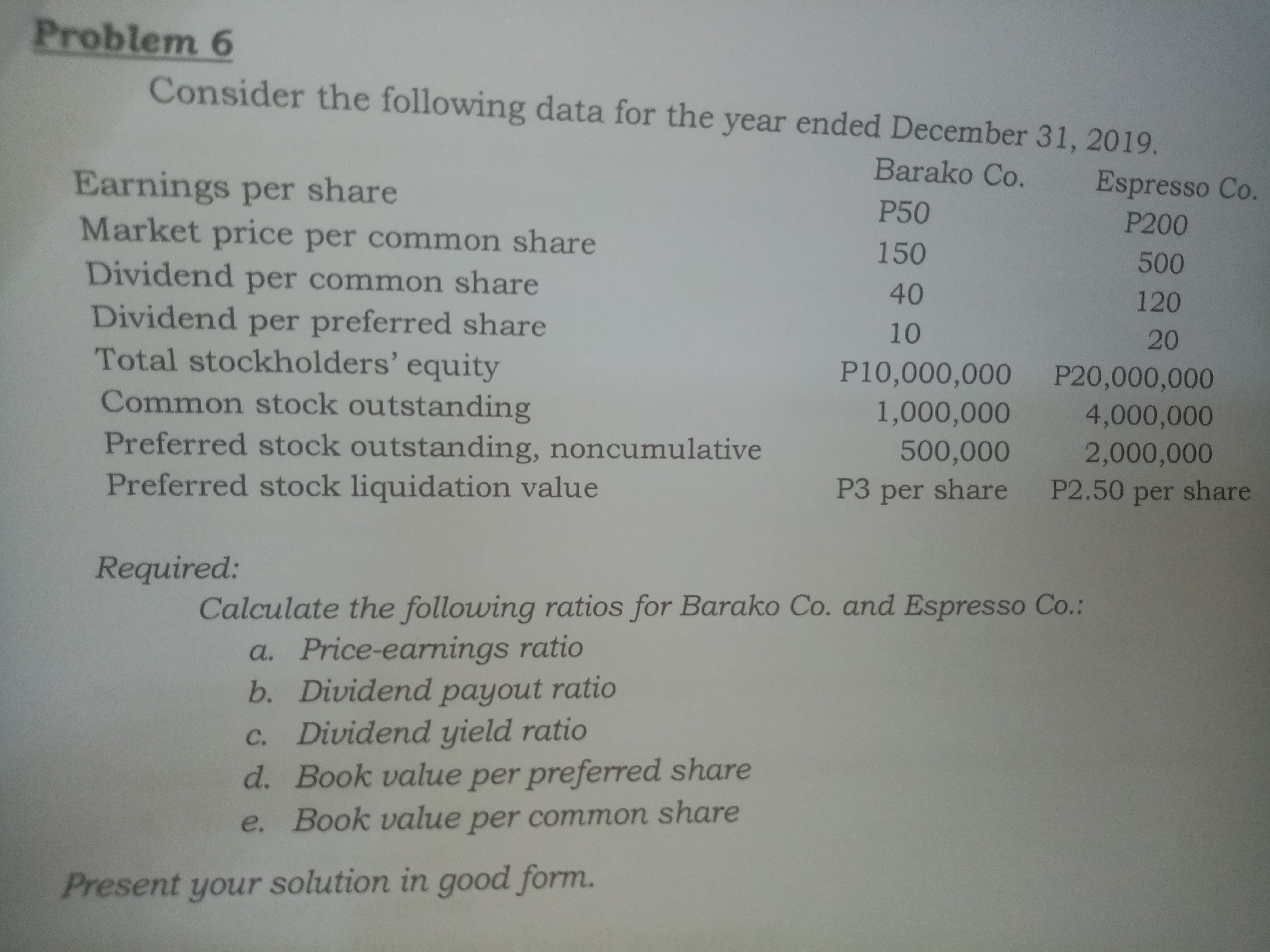

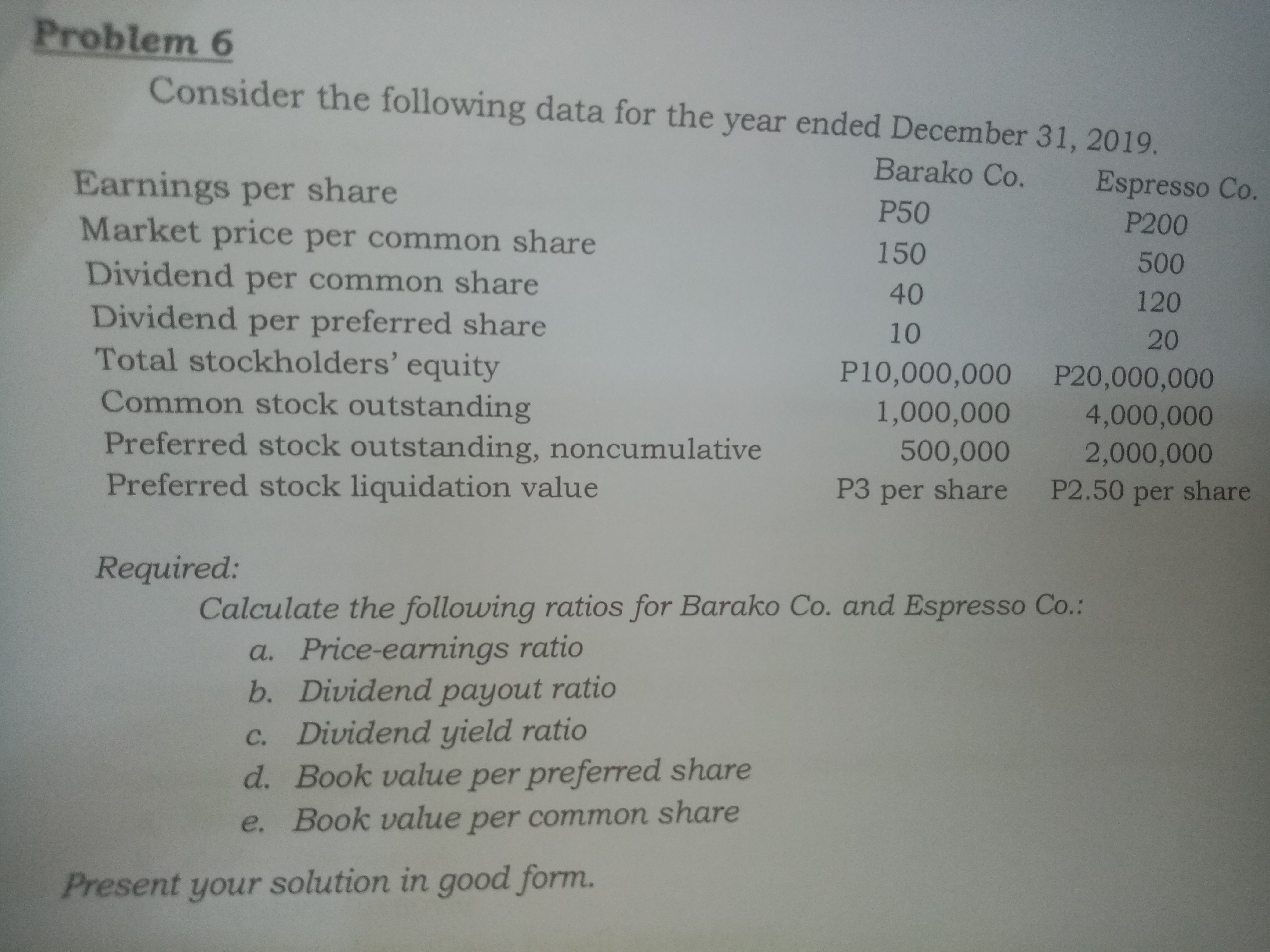

Question: Problem 6 Consider the following data for the year ended December 31, 2019. Earnings per share Barako Co. Espresso Co. P50 Market price per common

Problem 6 Consider the following data for the year ended December 31, 2019. Earnings per share Barako Co. Espresso Co. P50 Market price per common share P200 150 500 Dividend per common share 40 120 Dividend per preferred share 10 20 Total stockholders' equity P10,000,000 P20,000,000 Common stock outstanding 1,000,000 4,000,000 Preferred stock outstanding, noncumulative 500,000 2,000,000 Preferred stock liquidation value P3 per share P2.50 per share Required: Calculate the following ratios for Barako Co. and Espresso Co.: a. Price-earnings ratio b. Dividend payout ratio c. Dividend yield ratio d. Book value per preferred share e. Book value per common share Present your solution in good form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts