Question: Problem 6 Intro The table below shows information for 3 stocks. Security Beta Risk-free rate Expected market return Stock 1 1.9 Stock 2 1.2 Stock

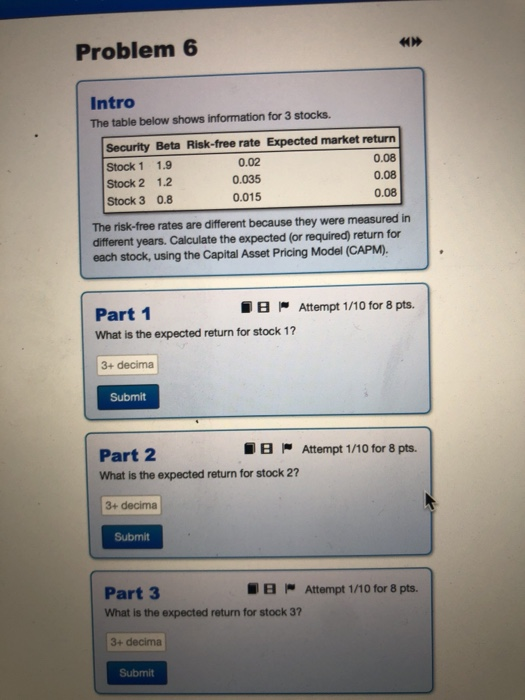

Problem 6 Intro The table below shows information for 3 stocks. Security Beta Risk-free rate Expected market return Stock 1 1.9 Stock 2 1.2 Stock 3 0.8 0.08 0.08 0.08 0.02 0.035 0.015 The risk-free rates are different because they were measured in different years. Calculate the expected (or required) return for each stock, using the Capital Asset Pricing Model (CAPM) BAttempt 1/10 for 8 pts. Part 1 What is the expected return for stock 1? 3+ decima Submit B Attempt 1/10 for 8 pts Part 2 What is the expected return for stock 2? 3+ decima Submit Part 3 What is the expected return for stock 37 BAttempt 1/10 for 8 pts 3+ decima Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts