Question: Problem 6-15 (algorithmic) Question Help Statoil's Arbitrage. Statoil, the national oil company of Norway, is a large, sophisticated, and active participant in both the currency

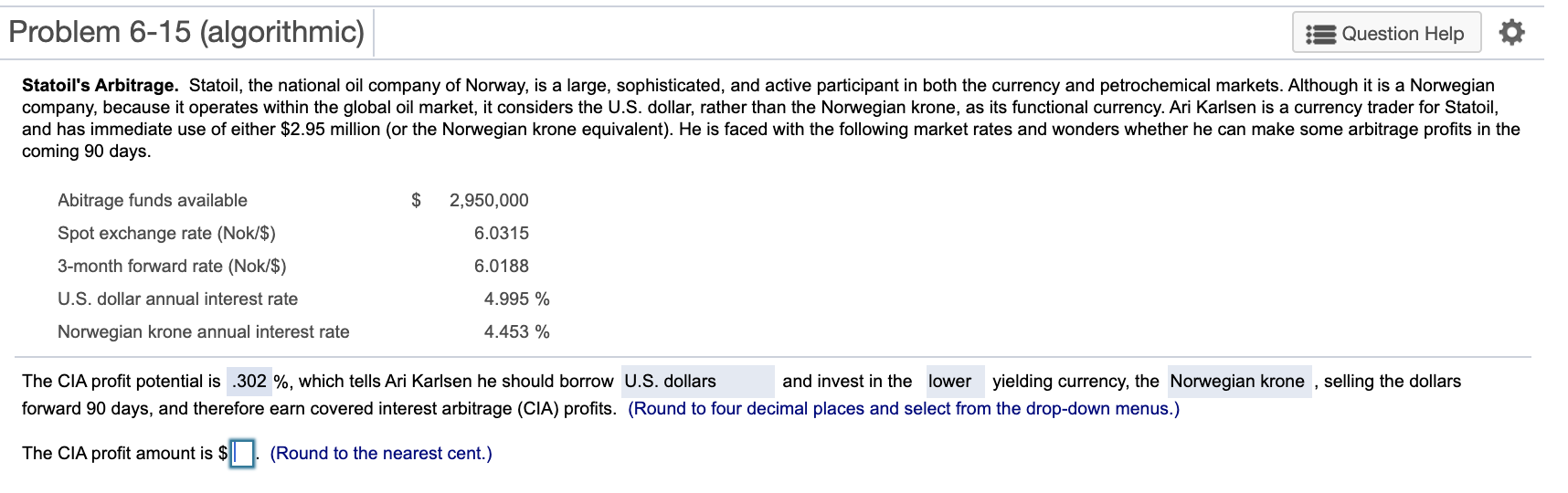

Problem 6-15 (algorithmic) Question Help Statoil's Arbitrage. Statoil, the national oil company of Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar, rather than the Norwegian krone, as its functional currency. Ari Karlsen is a currency trader for Statoil, and has immediate use of either $2.95 million (or the Norwegian krone equivalent). He is faced with the following market rates and wonders whether he can make some arbitrage profits in the coming 90 days. $ 2,950,000 6.0315 Abitrage funds available Spot exchange rate (Nok/$) 3-month forward rate (Nok/$) U.S. dollar annual interest rate 6.0188 4.995 % Norwegian krone annual interest rate 4.453 % The CIA profit potential is .302 %, which tells Ari Karlsen he should borrow U.S. dollars and invest in the lower yielding currency, the Norwegian krone , selling the dollars forward 90 days, and therefore earn covered interest arbitrage (CIA) profits. (Round to four decimal places and select from the drop-down menus.) The CIA profit amount is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts