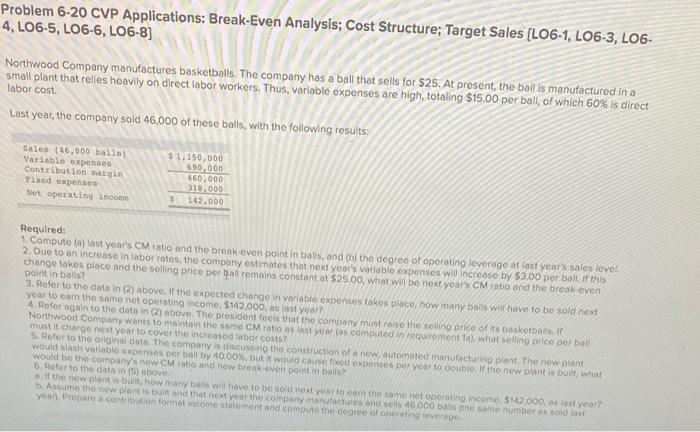

Question: Problem 6-20 CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO6-1, LO6-3, LO64, LO6-5, LO6-6, LO6-8] Northwood Company manufactures basketballs. The company has a ball

Problem 6-20 CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO6-1, LO6-3, LO64, LO6-5, LO6-6, LO6-8] Northwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relies heavily on direct labor workers. Thus, variable expenses are high, totaling $15.00 per bali, of which 60% is direct Last year, the company sold 46,000 of these balis, with the following results: Required: 1. Compute (0) last year's CM ratio and the break-even point in balls, and (b) the degree of operating loverage of last yearssates levelt 2. Due to an increase in labor rates, the company estimates that next yoor's vatiable expenses will incrcose by 53.00 per ball it this 3. Rofer to the data in (2) above. If the expected chancje in variabie expenses tahes place. how many bolls war flave fo be sold noxt 4. Rofor eam the tome net operating income, $142.000, as last yoar? Northwood Company wants to abovo. The president foels that the company mast felse the solling pice of its buskorbathe if must it charge nextyoar to cover the increased inbor costs? would slash vatioble expenses per boil by 40.00x, but it wo constivetion of a now, avtomated monufactufing plont, the new aisht

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts