Question: Problem 6-20 (Static) Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income [LO6-1, LO6-2, LO6-3] High Country,

![Income Statements; Explanation of Difference in Net Operating Income [LO6-1, LO6-2, LO6-3]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb3411e581f_89766fb341178ae8.jpg)

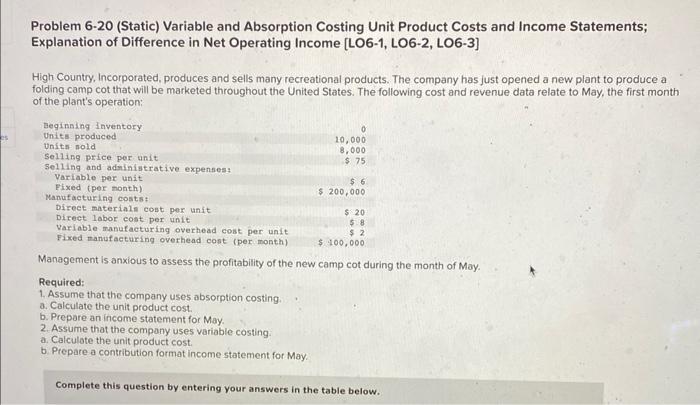

Problem 6-20 (Static) Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income [LO6-1, LO6-2, LO6-3] High Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing: a. Calculate the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. a. Calculate the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Prepare a contribution format income statement for May. Assume that the company uses varia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts