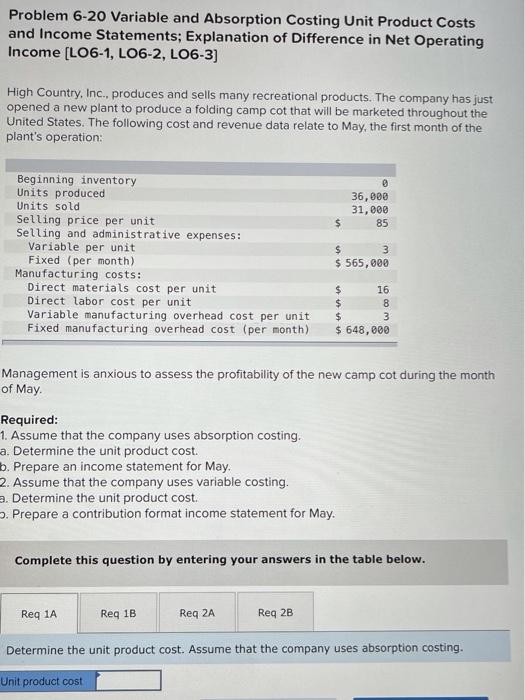

Question: Problem 6-20 Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income (LO6-1, LO6-2, LO6-3) High Country, Inc.,

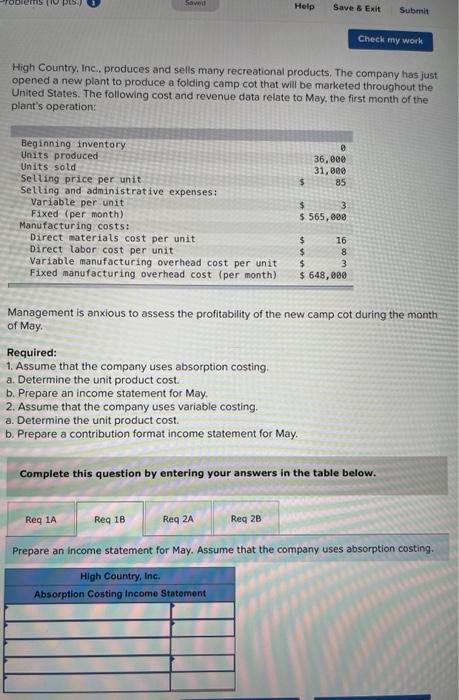

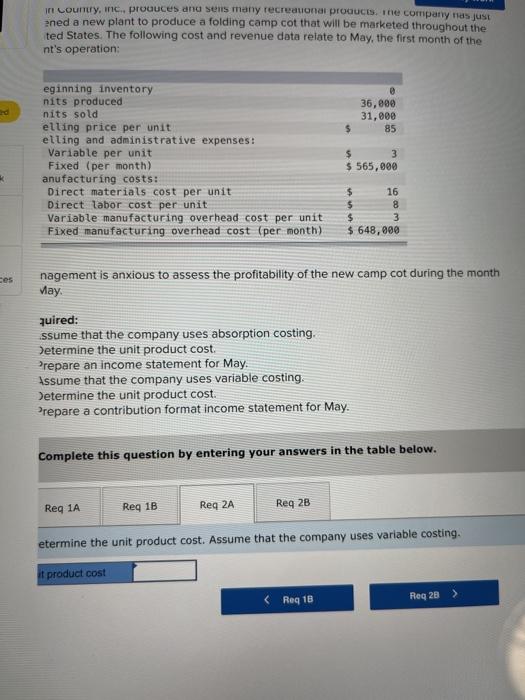

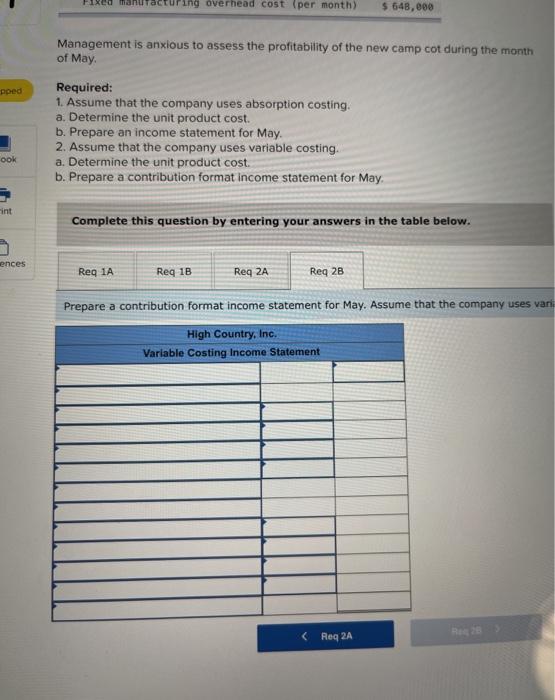

Problem 6-20 Variable and Absorption Costing Unit Product Costs and Income Statements; Explanation of Difference in Net Operating Income (LO6-1, LO6-2, LO6-3) High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: 36,000 31,000 85 Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) $ 3 $ 565,000 $ 16 $ 8 $ 3 $ 648,000 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Determine the unit product cost. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Req 1B Req 2A Req 2B Determine the unit product cost. Assume that the company uses absorption costing. Unit product cost Savo Help Save & Exit Submit Check my work High Country, Inc. produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: 36,000 31,000 85 $ Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) $ 3 $ 565,000 $ 16 $ 8 $ 3 $ 648,000 Management is anxious to assess the profitability of the new camp cot during the month of May Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Reg 1B Reg 2A Req 2B Prepare an income statement for May. Assume that the company uses absorption costing. High Country, Inc. Absorption Costing Income Statement in country, inc.. produces and sens many recreauona proucts. The company has just aned a new plant to produce a folding camp cot that will be marketed throughout the ted States. The following cost and revenue data relate to May, the first month of the nt's operation: 36,000 31,000 85 eginning inventory nits produced nits sold elling price per unit elling and administrative expenses: Variable per unit Fixed (per month) anufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) $ 3 $ 565,000 16 $ 8 $ 3 $ 648,000 ces nagement is anxious to assess the profitability of the new camp cot during the month . . quired: ssume that the company uses absorption costing, Determine the unit product cost. Prepare an income statement for May Assume that the company uses variable costing, Determine the unit product cost. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Reg 1B Req 2A Req 28 etermine the unit product cost. Assume that the company uses variable costing. it product cost ( Req 18 Reg 28 Fixed manufacturing overhead cost per month) $ 648,000 Management is anxious to assess the profitability of the new camp cot during the month of May pped Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing, a. Determine the unit product cost. b. Prepare a contribution format income statement for May. ook int Complete this question by entering your answers in the table below. ences Reg 1A Req 1B Req 2A Reg 2B Prepare a contribution format income statement for May. Assume that the company uses vari High Country, Inc. Variable Costing Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts