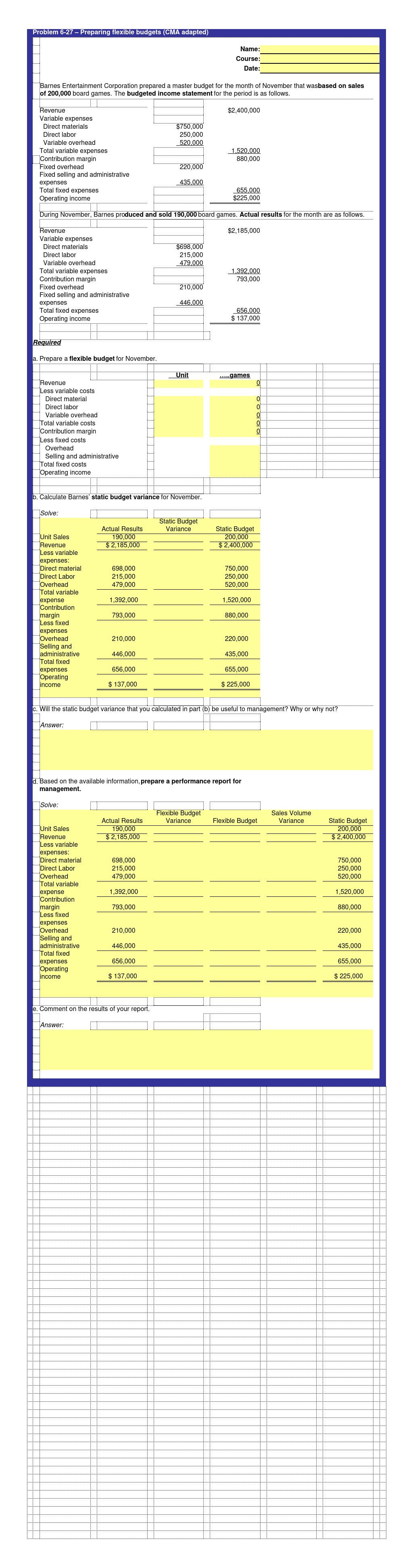

Question: Problem 6-27 - Preparing flexible budgets (CMA adapted) Name: Course: Date: Barnes Entertainment Corporation prepared a master budget for the month of November that wasbased

Problem 6-27 - Preparing flexible budgets (CMA adapted) Name: Course: Date: Barnes Entertainment Corporation prepared a master budget for the month of November that wasbased on sales of 200,000 board games. The budgeted income statement for the period is as follows. $2,400,000 $750,000 250,000 520.000 Revenue Variable expenses Direct materials Direct labor Variable overhead Total variable expenses Contribution margin Fixed overhead Fixed selling and administrative expenses Total fixed expenses Operating income 1,520,000 880,000 220,000 435,000 655.000 $225,000 During November, Barnes produced and sold 190,000 board games. Actual results for the month are as follows. $2,185,000 $698,000 215,000 479,000 Revenue Variable expenses Direct materials Direct labor Variable overhead Total variable expenses Contribution margin Fixed overhead Fixed selling and administrative expenses Total fixed expenses Operating income 1.392,000 793,000 210,000 446.000 656.000 $ 137,000 Required a. Prepare a flexible budget for November. Unit .....games 0 0 0 0 Revenue Less variable costs Direct material Direct labor Variable overhead Total variable costs Contribution margin Less fixed costs Overhead Selling and administrative Total fixed costs Operating income 0 b. Calculate Barnes' static budget variance for November. Solve: Static Budget Variance Actual Results 190,000 $ 2,185,000 Static Budget 200,000 $ 2,400,000 698,000 215,000 479,000 750.000 250,000 520,000 1,392,000 1,520,000 Unit Sales Revenue Less variable expenses: Direct material Direct Labor Overhead Total variable expense Contribution margin Less fixed expenses Overhead Selling and administrative Total fixed expenses Operating income 793,000 880,000 210,000 220,000 446,000 435,000 656,000 655,000 $ 137,000 $ 225,000 c. Will the static budget variance that you calculated in part (b) be useful to management? Why or why not? Answer: d. Based on the available information, prepare a performance report for management Solve: Flexible Budget Variance Flexible Budget Sales Volume Variance Actual Results 190,000 $ 2,185,000 Static Budget 200,000 $ 2,400,000 698,000 215,000 479,000 750,000 250,000 520,000 1,392,000 1,520,000 Unit Sales Revenue Less variable expenses: Direct material Direct Labor Overhead Total variable expense Contribution margin Less fixed expenses Overhead Selling and administrative Total fixed expenses Operating income 793,000 880,000 210,000 220,000 446,000 435,000 656,000 655,000 $ 137,000 $225,000 e. Comment on the results of your report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts