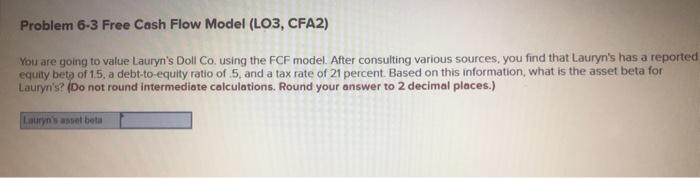

Question: Problem 6-3 Free Cash Flow Model (LO3, CFA2) You are going to value Lauryn's Doll Cousing the FCF model. After consulting various sources, you find

Problem 6-3 Free Cash Flow Model (LO3, CFA2) You are going to value Lauryn's Doll Cousing the FCF model. After consulting various sources, you find that Lauryn's has a reported equity beta of 15, a debt-to-equity ratio of 5, and a tax rate of 21 percent. Based on this information, what is the asset beta for Lauryn's? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Lauryn's so bela

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts