Question: The Edmonton Casting Company(ECC) is considering adding a new product line. The machinery's invoice price would be approximately $300,000, another $20,000 in shipping charges would

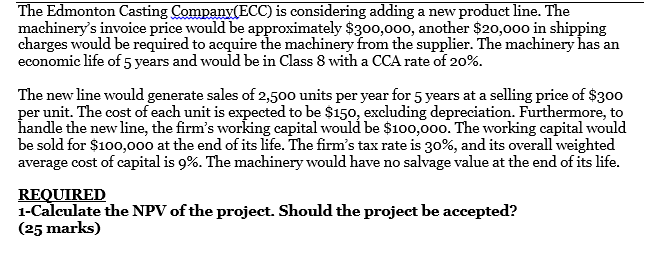

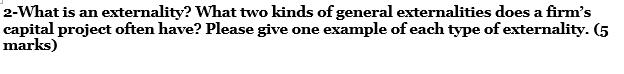

The Edmonton Casting Company(ECC) is considering adding a new product line. The machinery's invoice price would be approximately $300,000, another $20,000 in shipping charges would be required to acquire the machinery from the supplier. The machinery has an economic life of 5 years and would be in Class 8 with a CCA rate of 20%. The new line would generate sales of 2,500 units per year for 5 years at a selling price of $300 per unit. The cost of each unit is expected to be $150, excluding depreciation. Furthermore, to handle the new line, the firm's working capital would be $100,000. The working capital would be sold for $100,000 at the end of its life. The firm's tax rate is 30%, and its overall weighted average cost of capital is 9%. The machinery would have no salvage value at the end of its life. REQUIRED 1-Calculate the NPV of the project. Should the project be accepted? (25 marks) 2-What is an externality? What two kinds of general externalities does a firm's capital project often have? Please give one example of each type of externality. (5 marks) The Edmonton Casting Company(ECC) is considering adding a new product line. The machinery's invoice price would be approximately $300,000, another $20,000 in shipping charges would be required to acquire the machinery from the supplier. The machinery has an economic life of 5 years and would be in Class 8 with a CCA rate of 20%. The new line would generate sales of 2,500 units per year for 5 years at a selling price of $300 per unit. The cost of each unit is expected to be $150, excluding depreciation. Furthermore, to handle the new line, the firm's working capital would be $100,000. The working capital would be sold for $100,000 at the end of its life. The firm's tax rate is 30%, and its overall weighted average cost of capital is 9%. The machinery would have no salvage value at the end of its life. REQUIRED 1-Calculate the NPV of the project. Should the project be accepted? (25 marks) 2-What is an externality? What two kinds of general externalities does a firm's capital project often have? Please give one example of each type of externality

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts