Question: Problem 6-48 (algorithmic) Question Help An airline is considering two types of engine systems for use in its planes. Each has the same life and

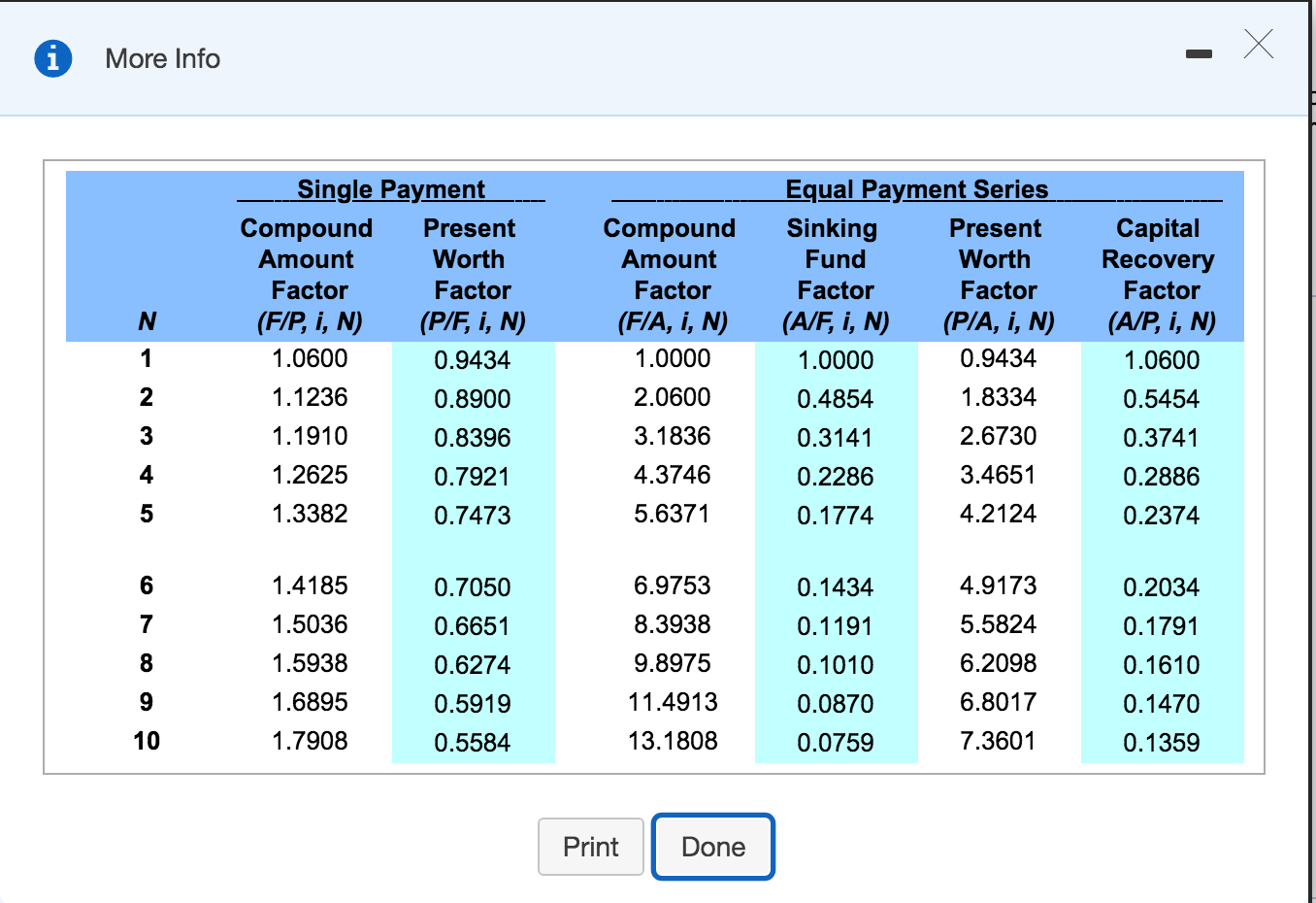

Problem 6-48 (algorithmic) Question Help An airline is considering two types of engine systems for use in its planes. Each has the same life and the same maintenance and repair record. System A costs $90,000 and uses 38,000 gallons per 1,000 hours of operation at the average load encountered in passenger service. System B costs $310,000 and uses 27,000 gallons per 1,000 hours of operation at the same level. Both engine systems have three-year lives before any major overhaul is required. On the basis of the initial investment, the systems have 8% salvage values. If jet fuel costs $2.07 a gallon (year 1) and fuel consumption is expected to increase at the rate of 5% per year because of degrading engine efficiency, which engine system should the firm install? Assume 4,000 hours of operation per year and a MARR of 6%. Use the AE criterion. What is the equivalent operating cost per hour for each engine? Assume an end-of-year convention for the fuel cost. 3 Click the icon to view the interest factors for discrete compounding when MARR = 6% per year The equivalent annual costs for system A are $ . (Round to the nearest dollar.) More Info Single Payment Compound Present Amount Worth Factor Factor (FIP, i, N) (PIF, i, N) 1.0600 0.9434 1.1236 0.8900 1.1910 0.8396 1.2625 0.7921 1.3382 0.7473 AWN-Z. Compound Amount Factor (F/A, i, N) 1.0000 2.0600 3.1836 4.3746 5.6371 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, I, N) 1.0000 0.9434 0.4854 1.8334 0.3141 2.6730 0.2286 3.4651 0.1774 4.2124 Capital Recovery Factor (A/P, I, N) 1.0600 0.5454 0.3741 0.2886 0.2374 Ovo 1.4185 1.5036 1.5938 1.6895 1.7908 0.7050 0.6651 0.6274 0.5919 0.5584 6.9753 8.3938 9.8975 11.4913 13.1808 0.1434 0.1191 0.1010 0.0870 0.0759 4.9173 5.5824 6.2098 6.8017 7.3601 0.2034 0.1791 0.1610 0.1470 0.1359 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts