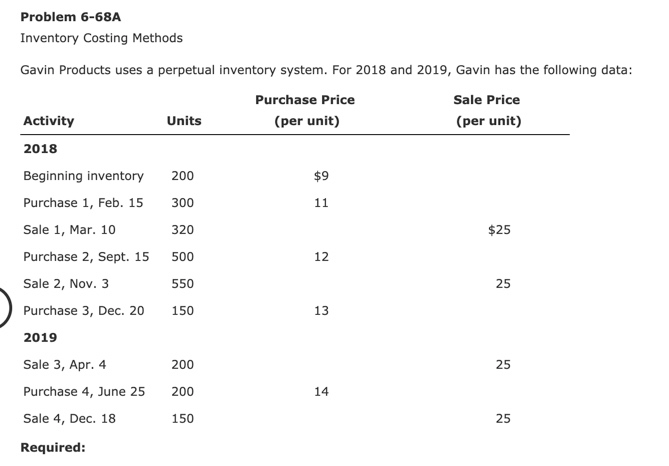

Question: Problem 6-68A Inventory Costing Methods Gavin Products uses a perpetual inventory system. For 2018 and 2019, Gavin has the following data: Purchase Price Sale Price

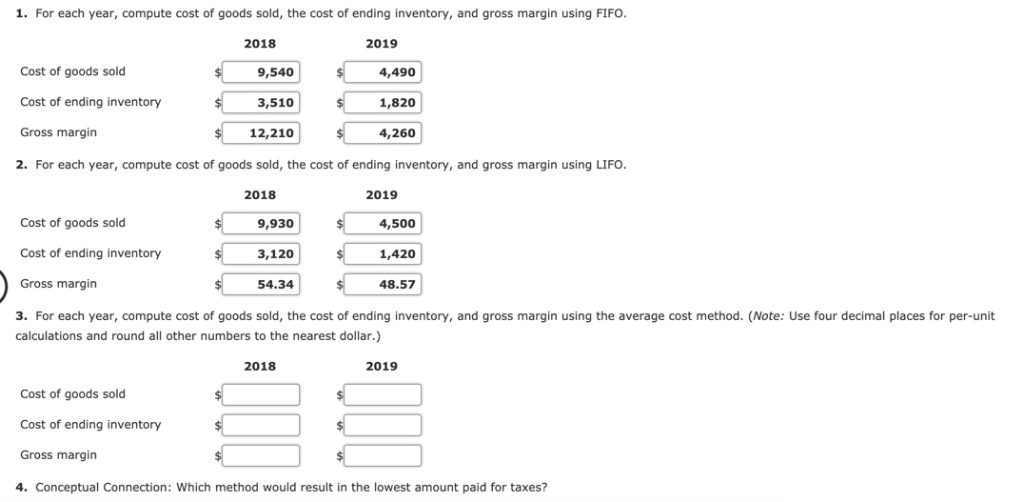

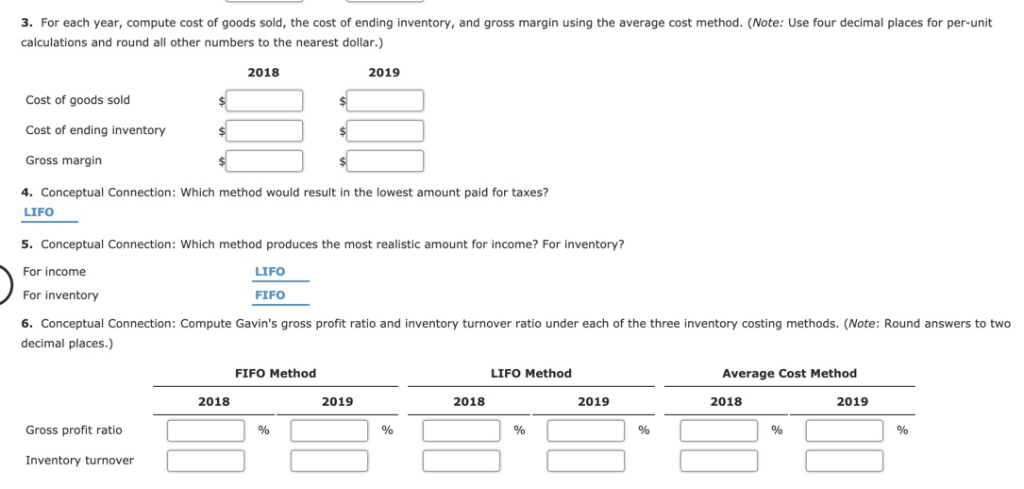

Problem 6-68A Inventory Costing Methods Gavin Products uses a perpetual inventory system. For 2018 and 2019, Gavin has the following data: Purchase Price Sale Price (per unit) (per unit) Units Activity 2018 Beginning inventory 200 Purchase 1, Feb. 15 300 Sale 1, Mar. 10 Purchase 2, Sept. 15 500 Sale 2, Nov. 3 Purchase 3, Dec. 20150 2019 Sale 3, Apr. 4 Purchase 4, June 25 200 Sale 4, Dec. 18 Required $9 $25 320 12 550 25 13 200 25 14 150 25 1. For each year, compute cost of goods sold, the cost of ending inventory, and gross margin using FIFO 2018 2019 Cost of goods sold Cost of ending inventory Gross margin 2. For each year, compute cost of goods sold, the cost of ending inventory, and gross margin using LIFO 9,540 3,510 12,210 4,490 1,820 4,260 2018 2019 Cost of goods sold Cost of ending inventory Gross margin 3. For each year, compute cost of goods sold, the cost of ending inventory, and gross margin using the average cost method. (Note: Use four decimal places for per-unit 9,930 3,120 54.34 4,500 1,420 48.57 calculations and round all other numbers to the nearest dollar.) 2018 2019 Cost of goods sold Cost of ending inventory Gross margin 4. Conceptual Connection: Which method would result in the lowest amount paid for taxes? 3. For each year, compute cost of goods sold, the cost of ending inventory, and gross margin using the average cost method. (Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 2018 2019 Cost of goods sold Cost of ending inventory Gross margin 4. Conceptual Connection: Which method would result in the lowest amount paid for taxes LIFO 5. Conceptual Connection: Which method produces the most realistic amount for income? For inventory? For income For inventory 6. Conceptual Connection: Compute Gavin's gross profit ratio and inventory turnover ratio under each of the three inventory costing methods. (Note: Round answers to two decimal places.) LIFO FIFO FIFO Method LIFO Method Average Cost Method 2018 2019 2018 2019 2018 2019 Gross profit ratio Inventory turnover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts