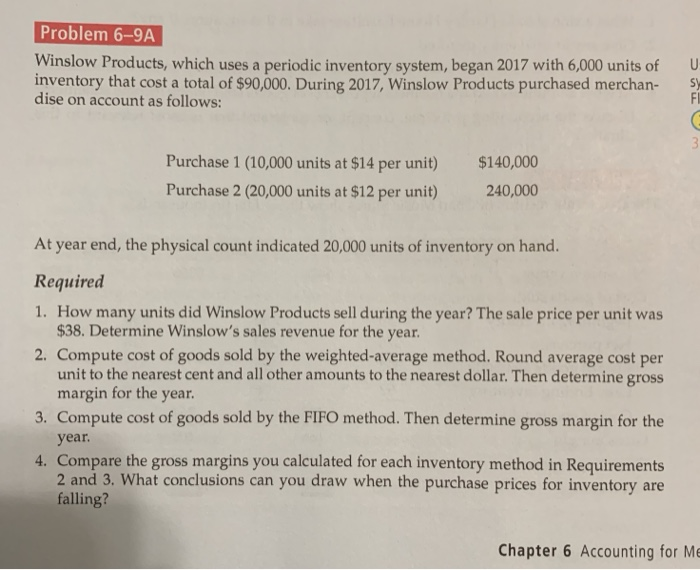

Question: Problem 6-9A Problem 6-9A Winslow Products, which uses a periodic inventory system, began 2017 with 6,000 units of U inventory that cost a total of

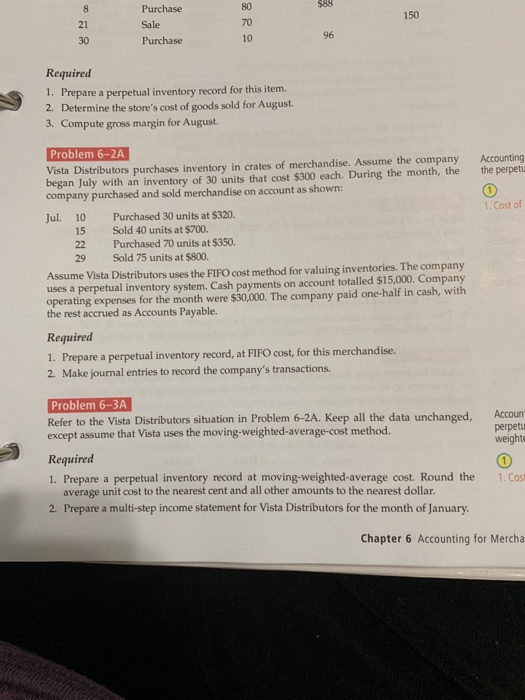

Problem 6-9A Winslow Products, which uses a periodic inventory system, began 2017 with 6,000 units of U inventory that cost a total of $90,000. During 2017, Winslow Products purchased merchan- S dise on account as follows: Purchase 1 (10,000 units at $14 per unit) Purchase 2 (20,000 units at $12 per unit) $140,000 240,000 At year end, the physical count indicated 20,000 units of inventory on hand. Required 1. How many units did Winslow Products sell during the year? The sale price per unit was 2. Compute cost of goods sold by the weighted-average method. Round average cost per $38. Determine Winslow's sales revenue for the year. unit to the nearest cent and all other amounts to the nearest dollar. Then determine gross margin for the year year 2 and 3. What conclusions can you draw when the purchase prices for inventory are 3. Compute cost of goods sold by the FIFO method. Then determine gross margin for the 4. Compare the gross margins you calculated for each inventory method in Requirements falling? ng?hat cons Chapter 6 Accounting for Me Purchase Sale Purchase 80 70 10 150 21 30 96 Required 1. Prepare a perpetual inventory record for this item. 2. Determine the store's cost of goods sold for August 3. Compute gross margin for August Problem 6-2A Vista Distributors purchases inventory in crates of merchandise. Assume the company Accounting began July with an inventory of 30 units that cost $300 each. During the month, the the perpet company purchased and sold merchandise on account as shown: 1.Cost of 10 15 Sold 40 units at $700. 22 Purchased 70 units at $350 29 Sold 75 units at $800 Jul. Purchased 30 units at $320. Assume Vista Distributors uses the FIFO cost method for valuing inventories. The company uses a perpetual inventory system. Cash payments on account totalled $15,000. Company operating expenses for the month were $30,000. The company paid one-half in cash, with the rest accrued as Accounts Payable. Required 1. Prepare a perpetual inventory record, at FIFO cost, for this merchandise 2. Make journal entries to record the company's transactions. Problem 6-3A Refer to the Vista Distributors situation in Problem 6-2A. Keep all the data unchanged, Accoun except assume that Vista uses the moving-weighted-average-cost method. perpetu weighta Required 1. Prepare a perpetual inventory record at moving-weighted-average cost. Round the 1.Cost average unit cost to the nearest cent and all other amounts to the nearest dollar. 2. Prepare a multi-step income statement for Vista Distributors for the month of January Chapter 6 Accounting for Mercha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts