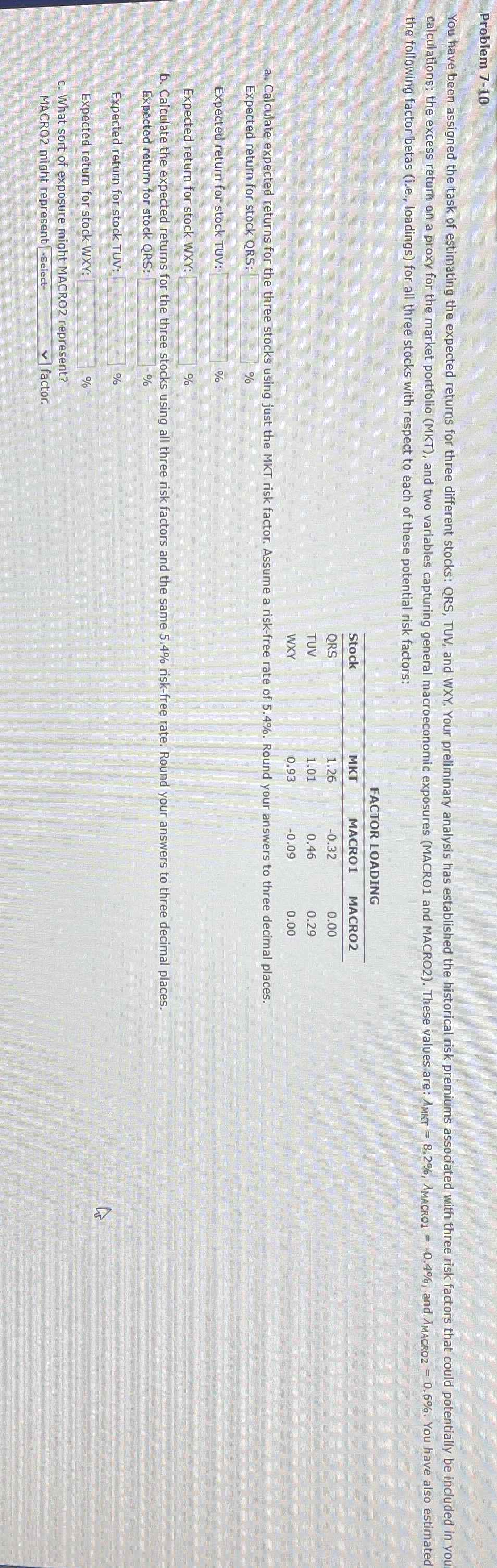

Question: Problem 7 - 1 0 the following factor betas ( i . e . , loadings ) for all three stocks with respect to each

Problem the following factor betas ie loadings for all three stocks with respect to each of these potential risk factors:

FACTOR LOADING

tableStockMKTMACROMACROQRSTUVWXY

a Calculate expected returns for the three stocks using just the MKT risk factor. Assume a riskfree rate of Round your answers to three decimal places. Expected return for stock QRS:

Expected return for stock TUV

Expected return for stock WXY

b Calculate the expected returns for the three stocks using all three risk factors and the same riskfree rate. Round your answers to three decimal places. Expected return for stock QRS

Expected return for stock TUV:

Expected return for stock WXY

c What sort of exposure might MACRO represent? MACRO might represent Select factor

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock