Question: Problem 7 ( 2 2 marks ) Tay and Trav ( T & T ) were recently engaged to be married and are planning their

Problem marks

Tay and Trav T & T were recently engaged to be married and are planning their wedding. The

couple plans to get married in two years and anticipates they will need $ saved for their

lavish wedding September

a How much would T&T have to invest today to have $ in years, if they can earn

on their investments? marks

b Suppose they invested the amount calculated in a however can only earn simple

interest. How much will they have accumulated in total for their wedding in years?

marks

c Calculate the rate of return compound interest T&T would have to earn over the next

two years if they invest only $ today if they want to have $ saved.

marks

d Calculate how long it would take T&T to accumulate $ if they invest $

today and can earn compound interest marks

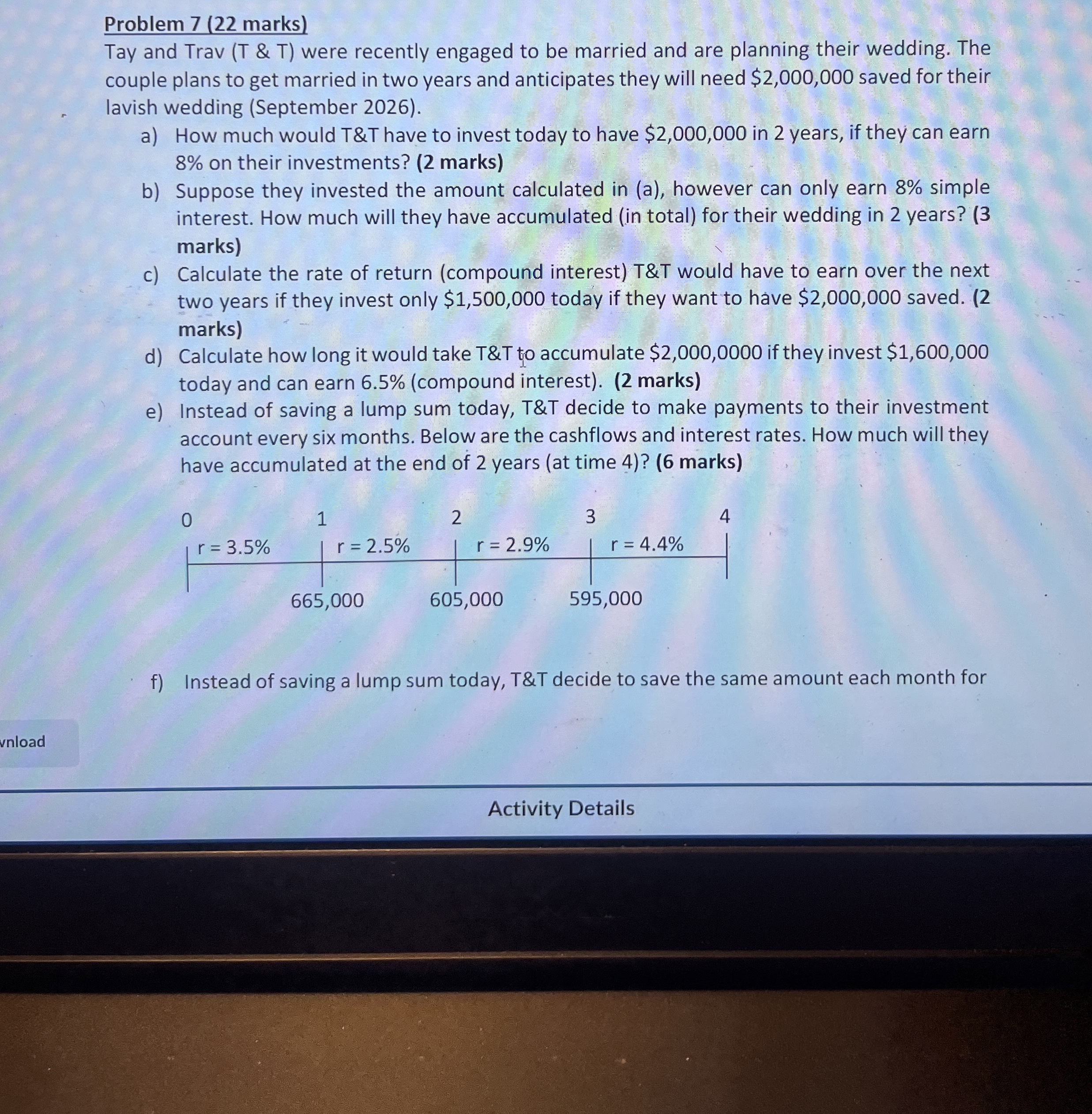

e Instead of saving a lump sum today, T&T decide to make payments to their investment

account every six months. Below are the cashflows and interest rates. How much will they

have accumulated at the end of years at time marks

f Instead of saving a lump sum today, T&T decide to save the same amount each month for the next two years to accumulate the $ they need for the wedding. If they can earn per month, calculate the mlnthly deposit required at the end of each month. marks

g How would your answer to f change of they make their deposits at the start of each month. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock