Question: Problem 7: Annuities 5 Points a) A local car dealership leases a high-end automobile for ( $ 6,000 ) annually. At the end of the

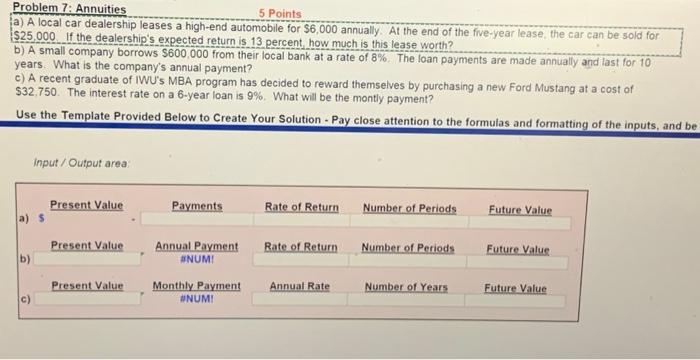

Problem 7: Annuities 5 Points a) A local car dealership leases a high-end automobile for \\( \\$ 6,000 \\) annually. At the end of the five-year lease, the car can be sold for is25,000 If the dealership's expected return is 13 percent. how much is this lease worth? b) A small company borrows \\( \\$ 600,000 \\) from their local bank at a rate of \8. The loan payments are made annually and last for 10 years. What is the company's annual payment? c) A recent graduate of IWU's MBA program has decided to reward themselves by purchasing a new Ford Mustang at a cost of \\( \\$ 32.750 \\). The interest rate on a 6-year loan is \9. What will be the montly payment? Use the Template Provided Below to Create Your Solution - Pay close attention to the formulas and formatting of the inputs, and be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts