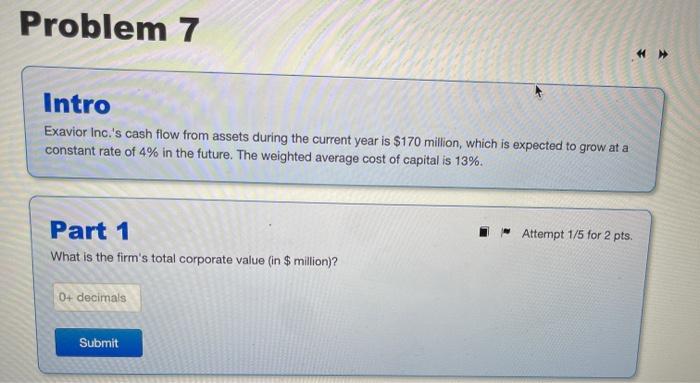

Question: Problem 7 Intro Exavior Inc.'s cash flow from assets during the current year is $170 million, which is expected to grow at a constant rate

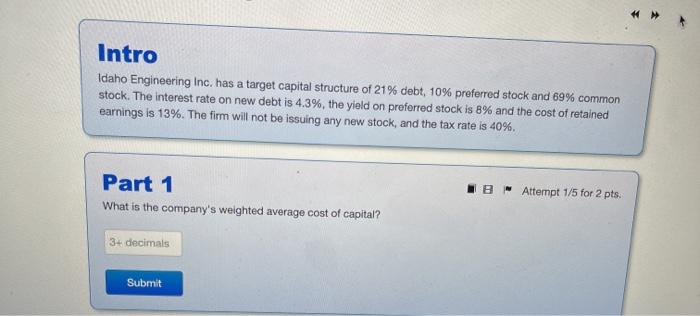

Problem 7 Intro Exavior Inc.'s cash flow from assets during the current year is $170 million, which is expected to grow at a constant rate of 4% in the future. The weighted average cost of capital is 13%. Attempt 1/5 for 2 pts. Part 1 What is the firm's total corporate value (in $ million)? 0+ decimals Submit Intro Idaho Engineering Inc. has a target capital structure of 21% debt, 10% preferred stock and 69% common stock. The interest rate on new debt is 4.3%, the yield on preferred stock is 8% and the cost of retained earnings is 13%. The firm will not be issuing any new stock, and the tax rate is 40%. Part 1 What is the company's weighted average cost of capital? IB Attempt 1/5 for 2 pts. 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts